FXORO Review: Safety, Regulation & Forex Trading Details

Abstract:FXORO holds dual regulation from CySEC and the Seychelles FSA, yet recent market data reflects a decline in user trust. While established in 2010, this Forex broker faces serious allegations regarding regulatory fines and persistent withdrawal delays.

FXORO is a well-established entity in the Forex trading market, operating since 2010. While it boasts a decade of history and dual regulatory licenses, recent complaints present a conflicting picture for investors. This FXORO review analyzes the current safety status, regulatory validity, and specific risk factors reported by users in 2024 and 2025.

Key Takeaways

- Moderate Score: WikiFX assigns a score of 5.55/10, indicating a medium-risk environment.

- Regulatory Action: Multiple detailed user reports cite a significant fine issued by CySEC in 2024 regarding compliance violations.

- Service Risks: Investors have reported issues ranging from blocked withdrawals to aggressive, unauthorized investment advice.

- Access Issues: Recent feedback indicates technical instability, including FXORO login difficulties for some traders.

FXORO Broker Summary: Regulatory Status & Influence

The FXORO broker profile shows a company with a significant footprint, particularly in the UK, Italy, and India. However, its “Influence Rank” is currently rated as C, suggesting it is not among the top-tier market leaders despite its longevity.

Is the License Real?

According to WikiFX records, FXORO operates under two main entities. It utilizes a hybrid model involving a top-tier European license and an offshore license.

| Regulator | License Type | Status | Entity Name |

|---|---|---|---|

| CySEC (Cyprus) | Standard Regulatory License | Regulated | MCA Intelifunds Ltd |

| FSA (Seychelles) | Offshore Regulatory License | Offshore Regulation | ORO FINTECH LIMITED |

Analyst Note: While the CySEC regulation usually offers strong protection for European clients (such as negative balance protection), the existence of an offshore entity (Seychelles FSA) means some clients may be registered under looser regulatory standards. This is a common structure in the Forex industry, but it requires traders to check exactly which entity holds their account.

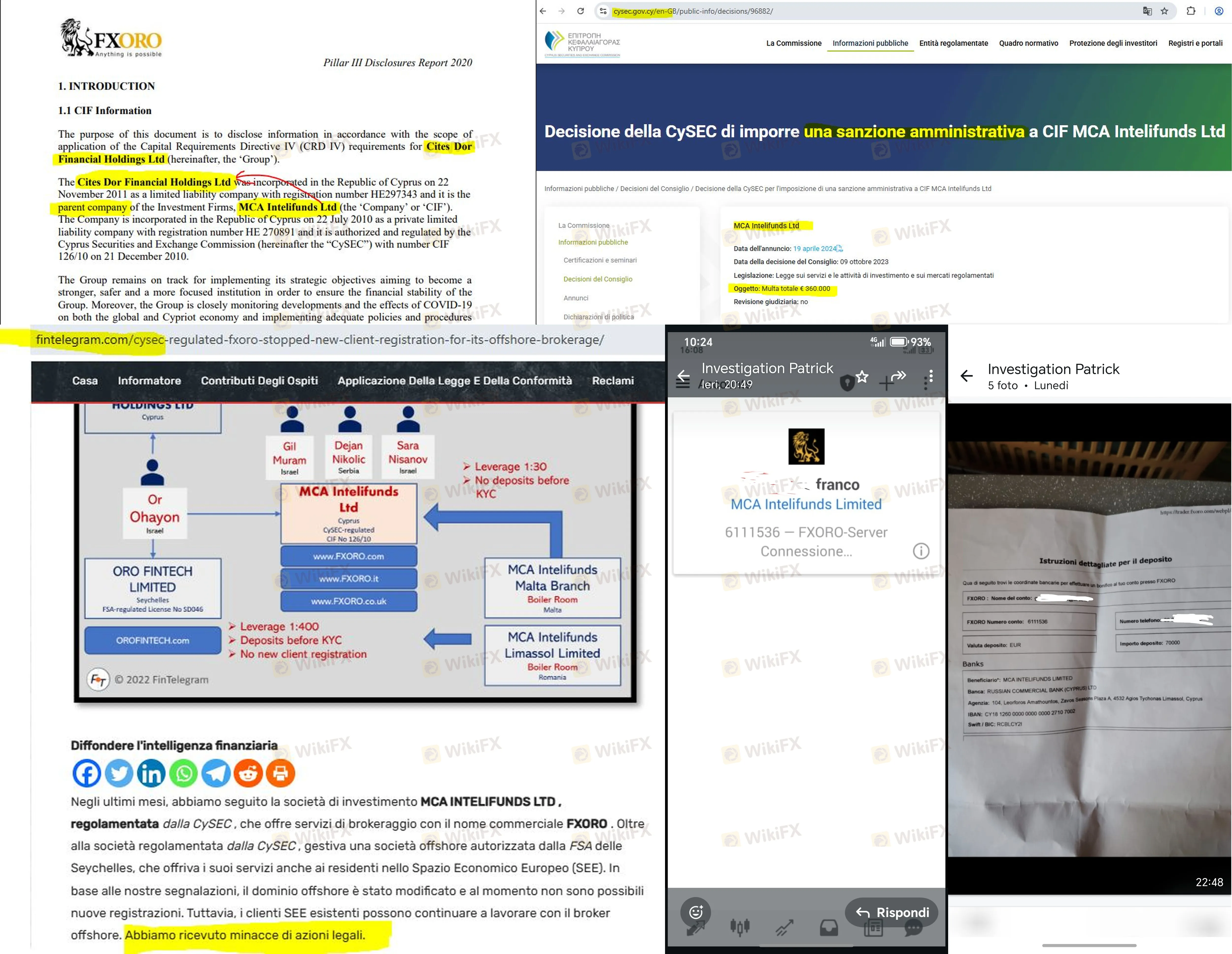

The “Fine” & Advisory Malpractice Claims

A critical part of this FXORO regulation analysis involves recent user testimony referenced in the data.

reported Regulatory Violations (2024)

Multiple user reports from Italy (dated 2024 and 2025) cite a specific document published by CySEC on April 19, 2024. These reviews allege that the parent entity, MCA Intelifunds Ltd, was fined approximately 360,000 Euros.

- Alleged Violations: Users report the fine was related to a lack of fairness, failure to protect client interests, and offering unsuitable financial instruments.

- The “Advisor” Trap: A recurring complaint involves account managers providing investment advice. Users claim they were pressured into trades that led to capital loss, despite the broker's terms stating they do not offer financial advice. One user described this as conflicting with the “Market Maker” nature of the broker.

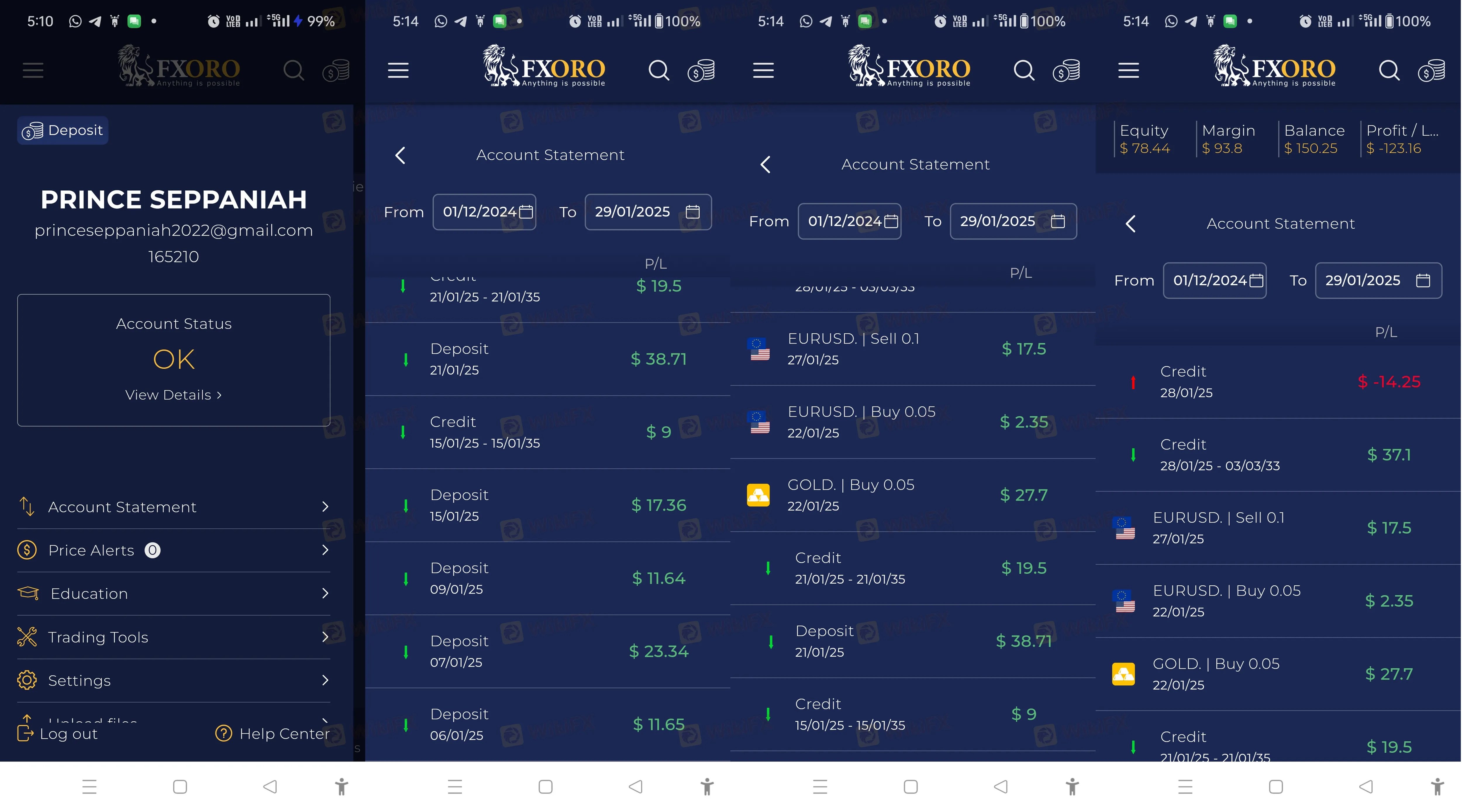

User Reviews: FXORO Login & Withdrawal Complaints

In the past three months alone, WikiFX has received 10 serious complaints. The narrative from these users contradicts the broker's claimed advantages of “multiple regulations.”

1. Withdrawal Stops & Silence

Investors from Saudi Arabia and Singapore have reported severe difficulties accessing their funds.

- Case Evidence: A user reported a balance of over $27,000 being inaccessible. After five months of attempts, the support team reportedly stopped responding to live chats and emails.

- Bonus Issues: Another user from India reported that bonus promises were not honored (receiving $50 instead of the promised $100), followed by pressure to deposit more funds after losses occurred.

2. Technical Stability and “Login” Issues

While financial disputes are common, technical reliability is also a concern. A user from Vietnam reported an inability to access the website, making it difficult to manage trades.

- Risk: If a FXORO login fails during high volatility, traders cannot close positions, potentially leading to unavoidable losses. This technical instability adds a layer of operational risk to the financial risk.

Conclusion: Is FXORO Safe?

Based on this FXORO review, the broker presents a mixed safety profile.

- Pros: Valid CySEC and FSA licenses; over 14 years of operation.

- Cons: Detailed reports of regulatory fines, aggressive account management practices, and verified withdrawal failures.

Recommendation: The 5.55 score suggests caution. The combination of valid regulation and severe user allegations creates a complex risk profile. Investors should strictly verify which legal entity they are onboarding with (Cyprus vs. Seychelles) and be wary of any “investment advice” offered by account managers, as this has been a primary source of user losses.

WikiFX Broker

Latest News

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Grand Capital Review 2026: Is this Broker Safe?

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

Rate Calc