AUDUSD Soars on Shock Election, Apple Shares Slump, Risk of S&P 500 Drop - US Market Open

Abstract:AUDUSD Soars on Shock Election, Apple Shares Slump, Risk of S&P 500 Drop - US Market Open

MARKET DEVELOPMENT – AUD Soars on Shock Election, Apple Shares Slump, Risk to S&P 500

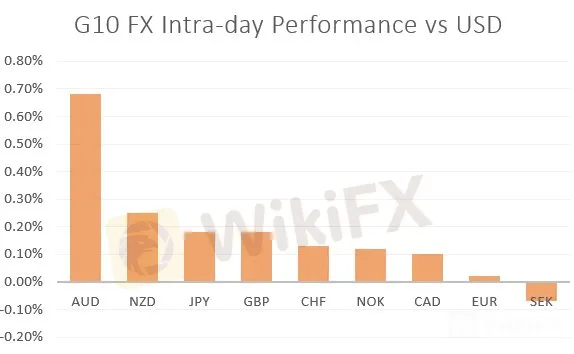

DailyFX Q2 2019 FX Trading ForecastsAUD: The Aussie outperforms following a shock election outcome, in which Prime Minister Scott Morrison secured re-election (full story). In reaction, the Aussie gapped higher at the Asia open, reclaiming the 0.69 handle against the greenback. However, as equity markets have headed lower throughout the European morning, risks are for gains to be faded. Alongside this, key headwinds in the form of trade war tensions and a potential RBA June rate cut are likely to limit upside. Reminder, RBA Governor Lowe due to speak tonight after RBA meeting minutes (calendar)

Crude Oil: Oil prices surged at the Asia open as Saudi Arabia signalled that cuts could be extended throughout the remainder of 2019 at the JMMC meeting, while President Trump had also stepped up his critical rhetoric towards Iran. Although, with equity prices beginning to push lower, oil prices have pared the majority of its initial gains.

Equities: US equity futures have headed lower amid the continued crackdown by the US on China‘s Huawei, which in turn has chipmakers come under pressure, while Google also stated that they are to restrict the company’s use on android services. Elsewhere, Apples price target had been cut by HSBC to $174 (median street price target = $220), citing concerns over China, while tariff led price increases on Apple products could also have dire consequences on demand. Apple shares currently lower by 2.4% in pre-market.

Source: DailyFX, Thomson Reuters

DailyFX Economic Calendar: – North American Releases

IG Client Sentiment

How to use IG Client Sentiment to Improve Your Trading

WHATS DRIVING MARKETS TODAY

“Gold Price Sell-Off Continues, Silver Price Hits a Six-Month Low” by Nick Cawley, Market Analyst

“COT Report: Japanese Yen and Euro Shorts Collapse, USD Longs Reduced” by Justin McQueen, Market Analyst

“Crude Oil Price May Be Carving Out a Top” by Paul Robinson, Currency Strategist

“Using FX To Effectively Trade Global Market Themes at IG” by Tyler Yell, CMT , Forex Trading Instructor

--- Written by Justin McQueen, Market Analyst

To contact Justin, email him at Justin.mcqueen@ig.com

Follow Justin on Twitter @JMcQueenFX

Read more

AUS GLOBAL’s important notice on the launch of US stocks and European stocks!

We are honored to inform you that in order to provide customers with a richer trading experience, our company has launched more than 300 US and European stock trading products, including APPLE, ALIBABA, AMAZON, COCA-COLA, JD, EBAY, BMW, HSBC, SHELL and many other popular stocks which can provide 1:20 times leverage.

All Round Major Pairs Technical Analysis: EUR/USD, AUDUSD, And GBPUSD

The start of November has been a dwindling moment for the general major currency market. As essential economic updates flood the surface of the entire foreign exchange market, in which most of the currency pairs especially the major pairs were greatly affected by the impact of the economic releases. However, the US dollar was discovered to have held the main currency exchange performance metrics as the central economic updates from the US region tend to have determined the significant changes that have occurred in the major currency market so far.

Currencies wait for RBA to kick off big central bank week

The dollar hovered below recent highs on Tuesday as traders waited for the Reserve Bank of Australia to lead a handful of central bank meetings set to define the rates outlook this week.

US Dollar Holds Gains as Japan Boosts and China PMI Weighs. USD Volatility Ahead?

US DOLLAR, JAPAN ELECTION, USD/JPY, CHINA PMI, AUD/USD - TALKING POINTS

WikiFX Broker

Latest News

Gold Smashes Records: Poland Adds 150 Tons Amid Sovereign Buying Spree

"Sell America" Trade Intensifies as Transatlantic Rift Deepens

Japan’s ‘Truss Moment’: Bond Market Meltdown Forces BoJ Into a Corner

Fed Independence in Focus: Bessent Attacks Powell Ahead of Chair Nomination

From Scam Hub to Safe Bet? Cambodia Fights Back to Win Investors

PBOC Holds LPR Steady as Banks Guard Margins

Sterling Wavers as UK Payrolls Plunge and Wage Growth Slows

Trade War Escalates: Danish Fund Dumps Treasuries on Greenland Threats

Dollar Stumbles as 'Greenland Row' Sparks Tangible Capital Flight

Trans-Atlantic Fracture: EU Weighs 'Capital Option' as Tariff War Looms

Rate Calc