The Startling Differences Between Hedging and Arbitrage

Abstract:The two risk management investment tools - hedging vs arbitrage - have been helping investors achieve their respective financial goals. Explore this comparision to understand their functionalities, the investment purpose they serve, the risk attached, and several other aspects.

The two risk management investment tools - hedging vs arbitrage - have been helping investors achieve their respective financial goals. Arbitrage is a tool by which investors gain risk-free profits by leveraging price differentials across different markets. Hedging, on the other hand, is designed to reduce potential losses by offsetting risks. In this article, we will help you explore the differences between hedging and arbitrage and find out the suitable alternative for you.

Arbitrage Definition

Arbitrage is a calibrated strategy by which investors purchase an asset at a lower price in one market and sell it at a greater price in another market. This largely revolves around leveraging price differences to earn profits.

Example - A currency pair is trading at 1.1000 on one exchange and at 1.1003 on another exchange. So, an arbitrageur will buy the currency pair available at 1.1000 and sell it for 1.1003 to gain a profit of 0.0002.

The strategy works brilliantly amid varying prices across markets. However, as markets become increasingly efficient, the profits tend to diminish.

Hedging Mechanism

Hedging is a proven financial investment strategy that helps reduce the risks associated with price movements in an asset. It helps offset a position by using some derivatives, such as futures or options, to protect against potential loss. For example, exporters expecting payment in Euros can enter into a forward contract to lock in the exchange rate to hedge against currency fluctuations.

The hedging mechanism helps stabilize cash flows and financial results while protecting against unfavorable price movements. On the downside, it reduces potential upside gains for the investors. At the same time, investors need to pay costs such as premiums or meet margin requirements.

Differences Between Hedging and Arbitrage

Still confused which of the two - Hedging vs Arbitrage - is better for you? We get it clear for you through this comparative analysis based on various aspects such as the investment objective, risk, time horizon, etc.

Investment Objective

Arbitrage is designed to maximize profits for investors, while hedging deals with minimizing investment risks for them.

Investment Risk

Arbitrage is a risk-free approach to reaping profits, while hedging helps reduce risks, but it may not be able to eliminate them.

Primary Tools

Arbitrage leverages market inefficiencies to help investors post high profits, while hedging uses derivatives such as futures, options or swaps to mitigate investment risks.

Time Horizon

Arbitrage works well over the short term, whereas hedging works better over the long term.

Market Impact

While arbitrage helps equalize prices across markets, hedging leads to stabilizing financial outcomes.

Summing Up

Hedging and arbitrage help investors with their unique characteristics. While arbitrage ensures efficiency by leveraging price differences, hedging protects against market uncertainties. Traders, based on their investment goals, exercise either of these two options to navigate a seemingly complex financial market.

Frequently Asked Questions (FAQs) on Hedging vs Arbitrage

Can I Use Hedging and Arbitrage Together?

Yes, you can use both of these strategies that serve your different investment purposes.

What are Some Common Hedging Instruments?

These are futures, options, forwards, and swaps

Can Arbitrage Ensure Profits Every Time?

While arbitrage is indeed a tool to earn risk-free profit, it does not guarantee it every time. Factors such as transaction costs, execution risk and market volatility can erode or eliminate profits.

Why Investors Resort to Hedging Amid Market Volatility?

Hedging helps protect investments from adverse price fluctuations and lets investors sail amid a highly volatile market.

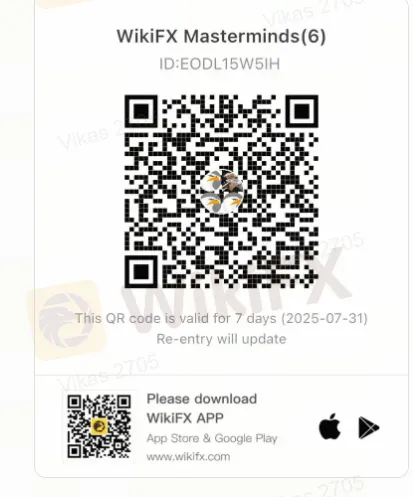

We cant wait for you to join our growing community - WikiFX Masterminds. Scan the QR code today to join and discuss forex.

Read more

Never Heard of Dynasty Trade? Here's Why You Should Be Worried

Have you heard this name before? No , it’s time you do because staying unaware could cost you. This platform is currently active in the forex trading and has been linked to several suspicious activities. Even if you’ve never dealt with it directly, there’s a chance it could reach out to you through ads, calls, messages, or social media. That’s why it’s important to know the red flags in advance.

Want to Deposit in the EVM Prime Platform? Stop Before You Lose It ALL

Contemplating forex investments in the EVM Prime platform? Think again! We empathize with those who have been bearing losses after losses with EVM Prime. We don't want you to be its next victim. Read this story that has investor complaints about EVM Prime.

WEEKLY SCAM BROKERS LIST IS OUT! Check it now

If you missed this week's fraud brokers list and are finding it difficult to track them one by one — don’t worry! We’ve brought together all the scam brokers you need to avoid, all in one place. Check this list now to stay alert and protect yourself from fraudulent brokers.

Catch the Latest Update on BotBro & Lavish Chaudhary

BotBro, an AI-based trading platform, became popular in India in 2024—but for negative reasons. Its founder, Lavish Chaudhary, who gained a huge following by promoting it heavily on social media. Since then, he has become well-known, but for many controversies. Let’s know the latest update about Botbro & Lavish Chaudhary.

WikiFX Broker

Latest News

Olymptrade Under Fire – Fraud Allegations and Investor Outrage

Hantec Markets Appoints New Executives for Growth in Dubai

Is the Forex Bonus a Genuine Perk or Just a Gimmick?

OctaFX Was Fined $37,000 for Operating Without a License

What Role do signals play in the forex trading?

5 Reasons Why Traders Are Losing Trust in Headway Broker

What WikiFX Found When It Looked Into Vestrado

Hantec Financial: A Closer Look at Its Licenses

eToro Joins Hands with Premiership Women’s Rugby

RM750 Million Lost to Investment Scams in Just Six Months

Rate Calc