Allied Top Review: Scam or Legit Broker?

Abstract:Allied Top review: Covering regulation, trading platforms, leverage, spreads, deposits, and real trader feedback for informed decisions.

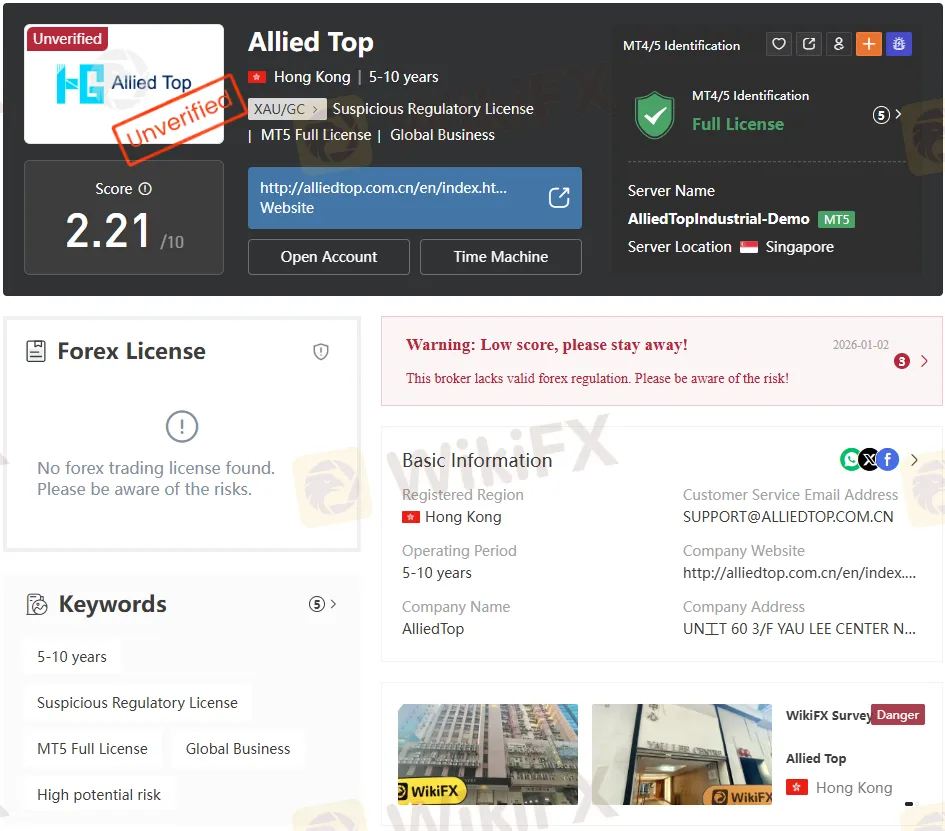

Allied Top Review: Regulatory Red Flags

Allied Top positions itself as a Hong Kong–based broker offering access to forex, metals, indices, stocks, commodities, and cryptocurrencies. Yet, the most pressing issue uncovered in this Allied Top review is its regulatory status. The firm claims to hold an FCA Investment Advisory License (No. 586463), but closer inspection reveals this is a suspicious clone of BCS Prime Brokerage Ltd, a legitimate UK entity. The FCA has flagged Allied Top as a clone operation, meaning its license claim is fraudulent.

Investigations into Allied Top‘s Hong Kong presence found no physical office, despite the company listing addresses in Hong Kong and Beijing. A similar on-site verification in Toronto, Canada, also revealed no operational office. These findings raise serious concerns about Allied Top’s legitimacy and transparency.

Allied Top Review: Trading Platforms and Servers

Allied Top advertises support for MetaTrader 5 (MT5), Web Trader, and even MT4. Server data shows two MT5 servers—“AlliedTopIndustrial-Demo” and “AlliedTopIndustrial-Server”—located in Singapore and China. Average execution speed is listed at 40.57 ms, which is competitive compared to industry standards.

However, the presence of demo servers and the lack of verified infrastructure undermine confidence. Competitor brokers with genuine FCA or ASIC licenses typically provide transparent server details, audited execution statistics, and verifiable office locations. Allied Tops opaque setup contrasts sharply with regulated peers such as IG or Saxo Bank.

Allied Top Review: Account Types and Fees

The broker promotes three account tiers:

| Account Type | Min Deposit | Forex Spread | General Spread | Commission |

| Standard | $0 | 1.6 pips | 3 pips | None |

| VIP | $5,000 | 1 pip | 2 pips | None |

| PRO | $10,000 | 0.5 pips | 1 pip | None |

Leverage is advertised up to 1:500, a level far higher than what FCA-regulated brokers allow (typically capped at 1:30 for retail clients). While high leverage may appeal to speculative traders, it significantly increases risk.

Deposit and withdrawal methods are limited to wire transfer and debit card. Competitors such as Pepperstone or IC Markets offer broader payment options, including e-wallets and instant funding, which Allied Top lacks.

Allied Top Review: Trader Complaints and Exposure Cases

User reviews paint a troubling picture. Multiple traders report frozen accounts and blocked withdrawals:

- One account holder claimed Allied Top froze $84,000, while falsely displaying a $10 million withdrawal that never arrived.

- Another reported escalating withdrawal demands—first $250, then $500, then $1,000—before access was denied.

- A third case involved 630,000 yuan locked for over 20 days, with customer service ceasing communication entirely.

These cases suggest Allied Top engages in systematic withdrawal obstruction, a hallmark of fraudulent brokers. In contrast, regulated competitors must comply with strict client fund segregation and withdrawal transparency rules.

Allied Top Review: Domain and Corporate Transparency

Allied Top operates two domains:

- alliedtopx.com (IP: 45.194.22.184, Singapore)

- alliedtop.com.cn (IP: 182.61.179.36, China)

The lack of a verifiable corporate entity behind these domains, combined with cloned FCA license claims, raises significant red flags. Genuine brokers typically list corporate registration numbers, audited financials, and clear ownership structures. Allied Top provides none.

Allied Top Review: Pros and Cons

| Pros | Cons |

| Wide range of tradable assets (170+) | Suspicious clone FCA license |

| MT5 platform available | No verified physical office |

| No minimum deposit (Standard account) | Limited payment options |

| Live chat support | Multiple withdrawal complaints |

Allied Top Review: Competitor Comparison

- IG Group (FCA-regulated): Transparent regulation, capped leverage at 1:30, audited financials, and global offices.

- Pepperstone (ASIC & FCA): Multiple funding options, strong reputation, and clear compliance.

- Allied Top: Suspicious clone license, unverifiable offices, withdrawal complaints, and opaque corporate structure.

The contrast is stark. Allied Tops offering may appear attractive on paper—MT5 access, high leverage, and low spreads—but the lack of regulatory legitimacy and repeated user complaints make it a high-risk choice.

Bottom Line: Is Allied Top Legit?

No. Allied Top is not a legitimate broker. Evidence from regulatory authorities, failed office verifications, and trader complaints strongly indicate it is a fraudulent clone operation. While it advertises competitive spreads and leverage, these features are meaningless without regulatory oversight and client fund protection.

Traders seeking reliable platforms should avoid Allied Top and instead consider brokers with verified FCA, ASIC, or CySEC licenses. The risks of frozen accounts and lost deposits far outweigh any advertised benefits.

Final Verdict: Allied Top review findings confirm this broker is unsafe. Its suspicious FCA clone license, unverifiable offices, and repeated withdrawal issues make it a high-risk entity that traders should steer clear of.

Read more

STARTRADER Launches New Global Brand Identity

Global broker STARTRADER refreshes its brand identity, reinforcing trust, growth, and client focus through a modernized visual and strategic repositioning.

SogoTrade Fined $75K Amid Compliance Failures

FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

Zeven Global Review: WikiFX Risk Warning and Key Investor Considerations

A WikiFX review of Zeven Global reveals the absence of regulatory licensing, a low safety rating, and potential risks to investor protection.

FP Markets Marks 20 Years of Global Trading

FP Markets celebrates 20 years of innovation, global expansion, and award-winning service, reinforcing its role as a trusted multi-asset broker.

WikiFX Broker

Latest News

Gold Cements Historic 66% Gain as Silver Supply Crunch Looms for 2026

Scammed Twice: How a RM1,500 Loss Escalated to RM1.2 Million

Celebrate the New Year and Usher in a Safer 2026 for All Traders!

Is 4SYTE TRADING LTD Legit or a Scam? 5 Key Questions Answered (2025)

Poland Fines Trading Firms $5.7M Over Pyramid Schemes

AURO MARKETS Review 2025: Institutional Audit & Risk Assessment

Euro Under Siege: French Fiscal Crisis Weighs heavily on the Common Currency

SogoTrade Fined $75K Amid Compliance Failures

Indonesian Nickel Supply Cut Sends LME Prices Soaring

Fed Focus: Markets Pause for Minutes as 2026 'Dovish Shift' Looms

Rate Calc