SogoTrade Fined $75K Amid Compliance Failures

Abstract:FINRA fines SogoTrade $75,000 for market access control failures as TopFX advances synthetic indices trading and 24/7 multi-asset solutions.

SogoTrade Faces $75K FINRA Fine as Synthetic Indices Trading Grows

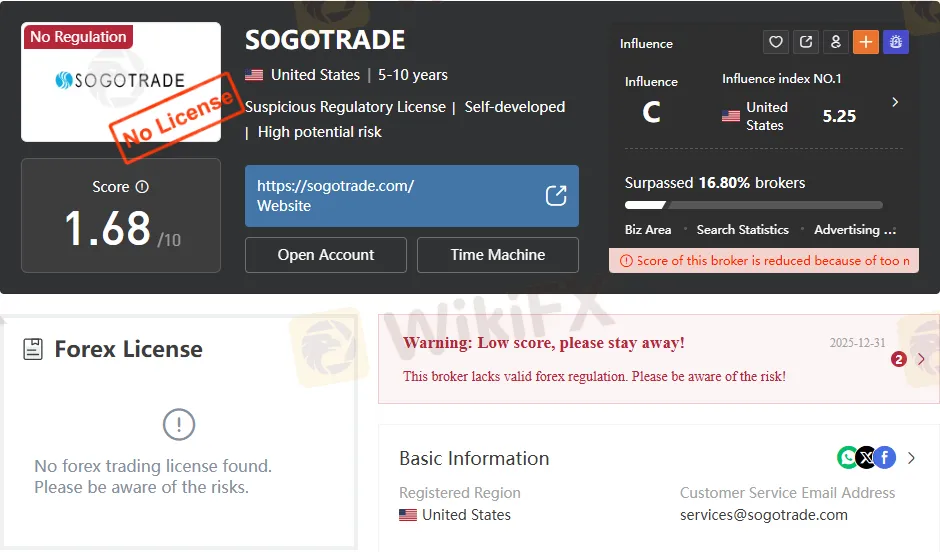

Financial Industry Regulatory Authority (FINRA) has fined SogoTrade, Inc. $75,000 for failing to maintain adequate risk management controls and supervisory procedures over its market access business. The action underscores growing regulatory scrutiny even as traders worldwide explore modern tools like synthetic indices trading on the cTrader platform, offered by innovative brokers such as TopFX.

According to FINRA, from January 2018 onward, SogoTrade failed to establish and document systems designed to prevent the entry of erroneous orders, violating several sections of the Securities Exchange Act and FINRA rules. Furthermore, the firm did not complete annual reviews and CEO certifications required under federal market access regulations. In addition to the fine, SogoTrade accepted a censure and agreed to remediate its compliance issues.

While legacy brokers like SogoTrade address internal control failures, new technology-driven firms are setting higher operational standards. TopFX, for instance, continues to expand its multi-asset trading solutions and features, attracting traders seeking stability and flexibility. The companys synthetic indices trading on the cTrader platform enables investors to trade non-correlated assets that mirror global market movements, providing continuous trading access 24/7 — a key advantage of trading synthetic indices.

But how do synthetic indices work in trading? Unlike traditional assets tied to real-world markets, synthetic indices simulate price behavior through algorithms, offering consistent volatility and reduced exposure to geopolitical risks. TopFX synthetic indices features and benefits include real-time execution speeds, transparent pricing, and seamless integration across asset classes.

As regulatory bodies tighten oversight on risk controls, the rise of algorithmic and synthetic instruments highlights a shift toward more resilient, technology-enabled market participation — where compliance, speed, and innovation increasingly define competitive advantage.

Read more

SEVEN STAR FX Exposure: Do Traders Face Account Blocks & Withdrawal Denials?

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.

Pinnacle Pips Forex Fraud Exposed

Scam alert on Pinnacle Pips: Unregulated, denies $20K withdrawal via pinnaclepips.com fraud. South Korea victims speaking out—avoid this forex scam now!

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

The question "Is ZarVista legit?" is a crucial one that has led many traders, probably including you, to this page. Worries about the safety of your capital, problems with withdrawing funds, and whether you can trust a broker are not just reasonable concerns—they are necessary for staying safe in financial markets. This article aims to give you a clear, fact-based answer to that question. Our goal is to conduct a comprehensive legitimacy check, examining ZarVista's regulatory status, real user experiences, and its transparency regarding its operations. To be upfront, our detailed analysis of publicly available information shows major warning signs that every potential investor must think about before working with this broker. While ZarVista presents itself as a modern, worldwide trading partner, the evidence we have gathered shows a high-risk operation where trader capital is not properly protected. We will go through this evidence step-by-step, giving you the power to make an informe

WikiFX Broker

Latest News

Kraken Review 2025: Is This Forex Broker Safe?

IQ Option Review: The High-Stakes Game of Withholding Trader Capital

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Grand Capital Review 2026: Is this Broker Safe?

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

Rate Calc