CXMarkets Review 2026: Is CXMarkets a Safe Forex Broker or High-Risk Platform?

Abstract:CXMarkets review has attracted increasing attention among Forex traders searching for new trading opportunities. However, when evaluating any broker, regulation, transparency, and risk indicators are far more important than marketing claims.

CXMarkets review has attracted increasing attention among Forex traders searching for new trading opportunities. However, when evaluating any broker, regulation, transparency, and risk indicators are far more important than marketing claims.

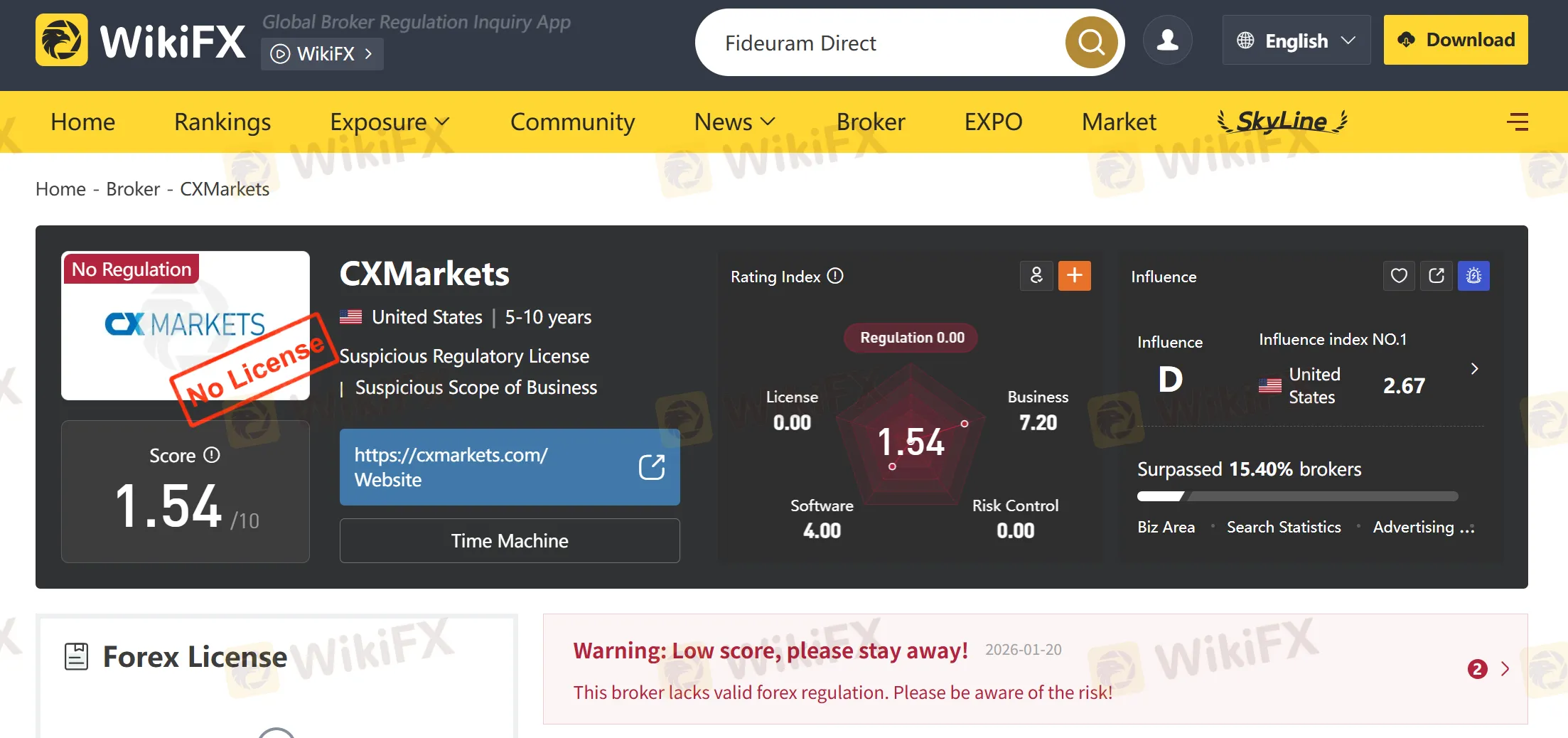

According to WikiFX, CXMarkets has received a low score of 1.54/10, raising serious concerns about its safety and credibility. In this review CXMarkets article, we analyze the brokers background, regulation status, trading offerings, risks, and compare it with better-known regulated Forex brokers.

What Is CXMarkets?

CXMarkets presents itself as an online Forex and CFD broker, offering access to popular financial instruments such as:

- Forex currency pairs

- Indices

- Commodities

- Possibly cryptocurrencies (depending on region)

Despite these offerings, CXMarkets brokers lack sufficient publicly available information regarding corporate ownership, regulatory licenses, and operational transparency—key warning signs for traders.

CXMarkets Regulation: Is CXMarkets Regulated?

One of the most critical questions in any CXMarkets review is regulation.

Regulation Status: High Risk

Based on publicly available data and WikiFX, CXMarkets regulation is either unclear or nonexistent. The broker does not hold a valid license from major financial regulators, such as:

- FCA (UK)

- ASIC (Australia)

- CySEC (Cyprus)

- NFA / CFTC (United States)

Unregulated Forex brokers pose significant risks, including fund misappropriation, withdrawal refusal, and lack of legal protection.

Regulation CXMarkets remains a major red flag for both beginner and experienced traders.

WikiFX Risk Assessment of CXMarkets

According to WikiFX, broker CXMarkets has been assigned a risk score of 1.54/10, which places it firmly in the high-risk broker category.

Key Risk Factors Highlighted by WikiFX:

- No valid regulatory license

- Limited transparency about company ownership

- Potential operational risks

- Insufficient investor protection

A score this low strongly suggests traders should proceed with extreme caution—or avoid the broker entirely.

Trading Products and Services (CXMarkets Forex)

Available Instruments (Claimed):

- Forex trading (major & minor pairs)

- CFDs on indices and commodities

However, CXMarkets Forex lacks clear disclosures regarding:

- Leverage limits

- Spread types (fixed or floating)

- Execution model (STP, ECN, or Market Maker)

This lack of clarity further increases trading risk.

CXMarkets Pros and Cons

Potential Advantages

- Access to Forex and CFD markets

- Simple onboarding process

Major Disadvantages

- No credible regulation

- Very low WikiFX score (1.54/10)

- Lack of transparency

- Unclear trading conditions

- Weak investor protection

CXMarkets vs Regulated Forex Brokers (Comparison Table)

| Feature | CXMarkets | Regulated Broker (FCA/ASIC Example) |

|---|---|---|

| Regulation | None / Unverified | FCA / ASIC / CySEC |

| WikiFX Score | 1.54 / 10 | 7.5 – 9.5 / 10 |

| Fund Safety | No protection | Segregated accounts |

| Transparency | Low | High |

| Legal Protection | None | Strong |

| Suitable for Beginners | High risk | Yes |

Is CXMarkets Legit or a Scam?

While CXMarkets markets itself as a Forex broker, the absence of valid regulation and its extremely low WikiFX score make it a high-risk trading platform.

This CXMarkets review does not classify the broker as outright illegal, but it clearly falls into the unsafe and unverified broker category, especially when compared to regulated alternatives.

Who Should Avoid CXMarkets?

You should avoid CXMarkets brokers if you:

- Are a beginner trader

- Require strong regulatory protection

- Value transparent trading conditions

- Want reliable withdrawals and dispute resolution

Final Verdict: Should You Trade With CXMarkets?

Final Rating: High Risk – Not Recommended

Based on WikiFX data, regulation gaps, and transparency issues, Forex CXMarkets does not meet the basic safety standards expected of a trustworthy broker.

Traders are strongly advised to choose fully regulated Forex brokers with proven track records, strong oversight, and higher WikiFX ratings.

Read more

Is Forex Still Worth It in 2026? Global Central Banks Are Splitting

Entering 2026, diverging central bank policies are reshaping global FX and bond markets, while economic momentum shifts from developed economies toward India. Meanwhile, an upcoming leadership transition at the US Federal Reserve presents a key underappreciated risk that could trigger renewed volatility in interest rates and the US dollar.

United Broker Exposure: Withdrawal Issues and Unjust Fees Reported

Is your fund withdrawal request pending with the United broker for a long time? Has the UK-based forex broker still not resolved your withdrawal issues? Does the broker demand multiple fee payments every time you seek withdrawals? Is the United customer support team inept in handling your trading queries efficiently? You are not alone! Many traders have made their displeasure known on several broker review platforms such as WikiFX. In this United review article, we have investigated several complaints against the broker. Take a look!

HIJA MARKETS User Reputation: Is It Safe or a Scam? An Evidence-Based Analysis

Is HIJA MARKETS safe or a scam? This is the key question for any trader thinking about using this platform, and our research aims to give a clear, fact-based answer. Based on proven information, Hija Markets shows several major warning signs that require serious caution. The platform started very recently in late 2024, has no financial oversight, and barely exists online - these are huge red flags. This article will examine these issues to show the possible risks to your capital. We will look at the company's background, rules it follows, and how open it is about its business. Before investing with any broker, checking it independently is essential for safety. We strongly suggest using a complete platform, such as WikiFX, to check a broker's legal status and user reviews as your first step.

HIJA MARKETS Regulation: A Complete Guide to Understanding Its Unregulated Status

s Hija Markets regulated? After checking official regulatory databases, we can confirm that Hija Markets is not a regulated broker. The company, Hija Global Markets Ltd, is registered as an International Business Company (IBC) in Saint Lucia. However, being registered as a business is very different from having a financial license that allows them to handle your capital for trading. Without a license from a recognized financial authority, there is no regulatory oversight, no protection for your capital, and no required process for resolving disputes. This article will explain the evidence behind this conclusion, show you the serious risks involved, and give you a clear guide on how to check this information for any broker. Before choosing any broker, especially one with warning signs like these, an important first step is to check its profile on a verification platform, such as WikiFX, to get the complete picture.

WikiFX Broker

Latest News

Gold Fun Corporation Ltd Review: A Deep Dive into Safety and Regulation

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Gold Tears Through $4,700 Barrier as Risk Premiums Spike

Rate Calc