Introduction of CES FUTURES

Abstract:Ces Futures is a regulated broker, offering trading on futures on various trading platform. The broker offers demo accounts, but little information about leverage, spreads, or account types is offered. Since little information is provided, there is a lack of transparency of the website.

| Ces Futures Review Summary | |

| Founded | 2010 |

| Registered Country/Region | China |

| Regulation | CFFE (Regulated) |

| Market Instrument | Futures |

| Demo Account | ✅ |

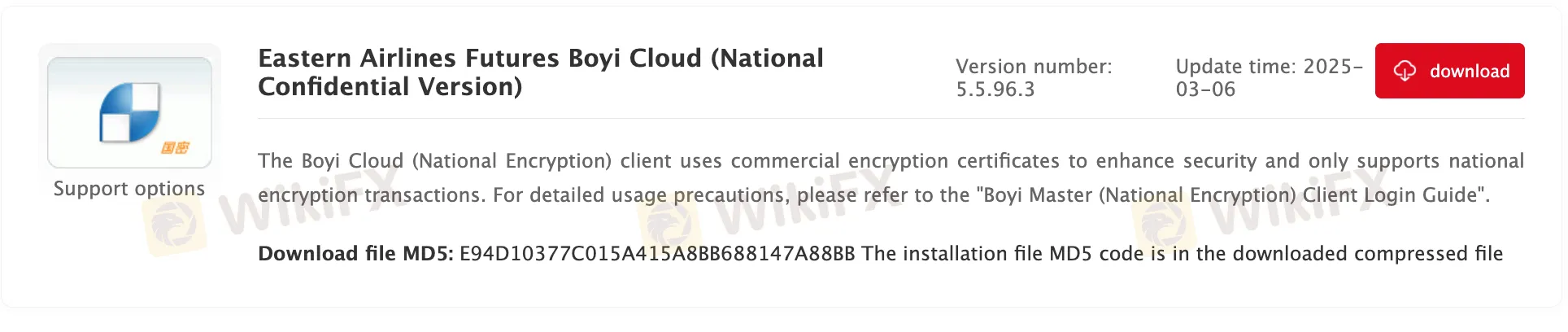

| Trading Platform | Eastern Futures APP, China Eastern Easy Star (Android version), China Eastern Easy Star (IOS version), China Eastern Express APP, Eastern Airlines Futures Polestar V9.5 Client, Eastern Airlines Futures Polestar V9.3 Client, Eastern Futures Express V3 New Generation Client, Eastern Futures Boyi Cloud Trading Edition, Eastern Airlines Futures Market Software Winshun Edition (Wenhua WH6), Eastern Futures Express V2 Client, Eastern Futures Trading Pioneer Terminal, Eastern Futures Yisheng Polestar V8.5 Client, Eastern Futures Yisheng Classic Client V8.3, Kuaiqi V2 Trading Terminal (National Secret Version), Eastern Airlines Futures Boyi Cloud (National Confidential Version), etc. |

| Customer Support | Live chat |

| Tel: 4008-889-889 | |

| Wechat, tiktok | |

| Email: service@kiiik.com | |

Ces Futures Information

Ces Futures is a regulated broker, offering trading on futures on various trading platform.

Pros and Cons

| Pros | Cons |

| Various trading platforms | Limited types of trading products |

| Demo accounts | Exchange and margin fees applied |

| Regulated well | |

| Live chat support | |

| Long operation time |

Is Ces Futures Legit?

Yes. Ces Futures is licensed by CFFEX to offer services.

| Regulated Country | Regulator | Current Status | Regulated Entity | License Type | License No. |

| China Financial Futures Exchange | Regulated | 东航期货有限责任公司 | Futures License | 0153 |

What Can I Trade on Ces Futures?

Ces Futures offers trading on futures.

| Tradable Instruments | Supported |

| Futures | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Stocks | ❌ |

| Cryptos | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

The broker has not clearly provided the account types it offers. Clients can open demo accounts to start futures trading.

Ces Futures Fees

The broker requires exchange fees and margin fees for different types of trading instruments.

Trading Platform

The broker provides various trading platforms, including Eastern Futures APP, China Eastern Easy Star (Android version), China Eastern Easy Star (IOS version), China Eastern Express APP, Eastern Airlines Futures Polestar V9.5 Client, Eastern Airlines Futures Polestar V9.3 Client, Eastern Futures Express V3 New Generation Client, Eastern Futures Boyi Cloud Trading Edition, Eastern Airlines Futures Market Software Winshun Edition (Wenhua WH6), Eastern Futures Express V2 Client, Eastern Futures Trading Pioneer Terminal, Eastern Futures Yisheng Polestar V8.5 Client, Eastern Futures Yisheng Classic Client V8.3, Kuaiqi V2 Trading Terminal (National Secret Version) and Eastern Airlines Futures Boyi Cloud (National Confidential Version).

Available devices: desktop and mobile (IOS, Android).

Deposit and Withdrawal

No minimum deposit or withdrawal amount defined and no fees or charges specified. The website only shows the deposit and withdrawal time.

Read more

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

XSpot Wealth has found many negative comments from traders who have allegedly been deceived by the broker. Traders constantly accuse the broker of causing unnecessary withdrawal blocks and forcing them to continue depositing with it. Many user complaints emerged on WikiFX, a leading global forex regulation inquiry app. In this XSpot Wealth review article, we have investigated multiple complaints against the broker. Read on!

SEVEN STAR FX Exposure: Do Traders Face Account Blocks & Withdrawal Denials?

Did SEVEN STAR FX make unreasonable verification requests and block your forex trading account later? Did the broker prevent you from accessing fund withdrawals? Were you made to wait for a long time to receive a response from the broker’s customer support official? Have you had to seek legal assistance to recover your stuck funds? Well, these are some claims made by SEVEN STAR FX’s traders. In this SEVEN STAR FX review article, we have looked closely at the company’s operation, the list of complaints, and a take on its regulatory status. Keep reading to know the same.

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

When traders search for "Is ZarVista Safe or Scam," they want to know if their capital will be safe. Nice features and bonuses do not matter much if you can't trust the broker. This article skips the marketing talk and looks at real evidence about ZarVista's reputation. We want to examine actual user reviews, look into the many ZarVista Complaints, and check the broker's legal status to get a clear picture. The evidence we found shows serious warning signs and a pattern of major user problems, especially about the safety and access to funds. This report gives you the information you need to make a smart decision about this risky broker.

Pinnacle Pips Forex Fraud Exposed

Scam alert on Pinnacle Pips: Unregulated, denies $20K withdrawal via pinnaclepips.com fraud. South Korea victims speaking out—avoid this forex scam now!

WikiFX Broker

Latest News

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

Grand Capital Review 2026: Is this Broker Safe?

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

Rate Calc