IX Securities-Overview of Minimum Deposit, Leverage, Spreads

Abstract:IX Securities, a trading name of IX CAPITAL GROUP LIMITED, is allegedly a suspected fake clone forex broker registered in the Bahamas that claims to provide its clients with the industry-standard MetaTrader4 trading platform, leverage up to 1:500, variable spreads from 0 pips on some tradable assets, as well as a choice of two different account types.

Note: Since IX Securities official site (https://www.ixsecurities.com) is not accessible while writing this introduction, only a cursory understanding can be obtained from the Internet.

General Information & Regulation

IX Securities, a trading name of IX CAPITAL GROUP LIMITED, is allegedly a suspected fake clone forex broker registered in the Bahamas that claims to provide its clients with the industry-standard MetaTrader4 trading platform, leverage up to 1:500, variable spreads from 0 pips on some tradable assets, as well as a choice of two different account types.

Market Instruments

We didnt find any specific information about tradable asset classes provided by IX Securities on the Internet. However, from the name of the broker, we guess that it may offer securities trading. Also, according to the demo account, we found the broker also offers forex currency pairs.

Account Types

There are two live trading accounts offered by IX Securities, namely STP and ECN. However, there is no minimum initial deposit amount specified on the Internet.

Leverage

The maximum leverage ratio provided by IX Securities is much higher than most brokers, up to 1:500. Bear in mind that leverage can magnify gains as well as losses, inexperienced traders are not advised to use too high leverage.

Spreads & Commissions

Spreads are influenced by what type of accounts traders are holding. IX Securities reveals that the spread on the STP account is as low as 1.2 pips, while the clients on the ECN account can enjoy raw spreads from 0 pips. As for commissions, the broker says to offer ultra-low commissions.

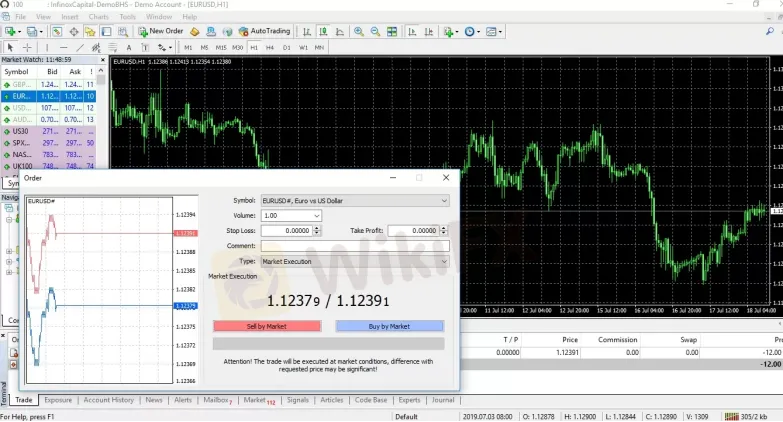

Trading Platform Available

When it comes to trading platforms available, IX Securities gives traders the industry-standard MetaTrader4 trading platform. MT4 is considered the worlds most widely-used trading platform, preferred by over 80% of users. It offers an intuitive and user-friendly interface, advanced charting and analysis tools, as well as copy and auto-trade options.

Deposit & Withdrawal

IX Securities accepts deposits and withdrawals with Visa and MasterCard, as well as bank transfers and e-wallets like Neteller, Skrill and UnionPay. The broker also charges some withdrawal handling fees. Withdrawal with Skrill and Neteller will be charged a handling fee of $15. Likewise, a $15 fee for withdrawals less than $50 while withdrawals over $50 will be free of handling fee. While for bank transfer withdrawal, $15 is charged by the broker, and bank charges are subject to each bank. As for the processing time of withdrawal requests, withdrawal with skrill and Neteller usually takes up to 1-7 working days; UnionPay withdrawals require 1-5 working days and bank transfers can be processed within 3-5 working days.

Customer Support

IX Securities‘ customer support can be reached by email: SUPPORT@IXSECURITIES.COM. Company address: 109 Church Street, Sandyport, PO Box SP 62756, Marina Village, Nassau, The Bahamas. However, this broker doesn’t disclose other more direct contact information like telephone numbers that most brokers offer.

Read more

Leo Review: Allegations of Profit Reversals & Weak Customer Support

Is your forex trading experience with Leo no short of a financial disaster? Does the Hong Kong-based forex broker deliberately cancel your profits when asking for withdrawals? Do you frequently encounter the issue of a NIL forex trading account balance? Does the Leo customer support team fail to resolve your trading queries? In this Leo review article, we have investigated many complaints against the broker. Take a look!

HIJA MARKETS User Reputation: Is It Safe or a Scam? An Evidence-Based Analysis

Is HIJA MARKETS safe or a scam? This is the key question for any trader thinking about using this platform, and our research aims to give a clear, fact-based answer. Based on proven information, Hija Markets shows several major warning signs that require serious caution. The platform started very recently in late 2024, has no financial oversight, and barely exists online - these are huge red flags. This article will examine these issues to show the possible risks to your capital. We will look at the company's background, rules it follows, and how open it is about its business. Before investing with any broker, checking it independently is essential for safety. We strongly suggest using a complete platform, such as WikiFX, to check a broker's legal status and user reviews as your first step.

HIJA MARKETS Regulation: A Complete Guide to Understanding Its Unregulated Status

s Hija Markets regulated? After checking official regulatory databases, we can confirm that Hija Markets is not a regulated broker. The company, Hija Global Markets Ltd, is registered as an International Business Company (IBC) in Saint Lucia. However, being registered as a business is very different from having a financial license that allows them to handle your capital for trading. Without a license from a recognized financial authority, there is no regulatory oversight, no protection for your capital, and no required process for resolving disputes. This article will explain the evidence behind this conclusion, show you the serious risks involved, and give you a clear guide on how to check this information for any broker. Before choosing any broker, especially one with warning signs like these, an important first step is to check its profile on a verification platform, such as WikiFX, to get the complete picture.

OANDA Expands CFD Trading to US and European Traders

OANDA enhances its CFD offering in Australia, adding US and European share CFDs for traders through the new OANDA One sub-account.

WikiFX Broker

Latest News

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Gold Tears Through $4,700 Barrier as Risk Premiums Spike

Investigation: The "Imposter" Trap Draining OANDA Traders

Rate Calc