WRC1

Abstract:Founded in 2023 and incorporated in Mauritius, WRC1 boasts over 300 trading assets ranging from stocks, indices, commodities, metals to Forex and cryptocurrency. WRC1 is still under control even with its varied array of products, which increases trading risks.

| WRC1 Review Summary | |

| Founded | 2023 |

| Registered Country/Region | Mauritius |

| Regulation | Unregulated |

| Market Instruments | Forex, Cryptocurrencies, Stocks, Indices, Commodities, Metals |

| Demo Account | ✅ |

| Leverage | Up to 1:500 |

| Spread | EUR/USD: As low as 16 PIPS (Diamond/Gold Accounts) |

| Trading Platform | iOS and Android Apps, Intuitive Web and Desktop Platforms |

| Min Deposit | 500 USD |

| Customer Support | Online chat |

| Email (English): support.en@wrpro.com | |

| Phone (English): +442080971406 | |

WRC1 Information

Founded in 2023 and incorporated in Mauritius, WRC1 boasts over 300 trading assets ranging from stocks, indices, commodities, metals to Forex and cryptocurrency. WRC1 is still under control even with its varied array of products, which increases trading risks.

Pros and Cons

| Pros | Cons |

| Wide range of tradable instruments | Unregulated |

| High leverage up to 1:500 | High spreads on entry-level accounts |

| Multiple payment options | Limited information about fees |

Is WRC1 Legit?

No acknowledged financial authority regulates WRC1. It is not licensed in Mauritius, where it is registered, and it is not subject to the supervision of internationally renowned regulatory agencies like the FCA (UK), ASIC (Australia), or other significant authorities.

Wrc1.com was registered on June 21, 2023, and expires on June 21, 2025. The last update was October 25, 2023.

What Can I Trade on WRC1?

Currency pairs, indices, commodities, stocks, cryptocurrencies, metals, and more than 300 trading assets are all available on WRC1. The instruments that were supported are summarized below:

| Tradable Instruments | Supported |

| Forex | ✔ |

| Cryptocurrencies | ✔ |

| Stocks | ✔ |

| Indices | ✔ |

| Commodities | ✔ |

| Metals | ✔ |

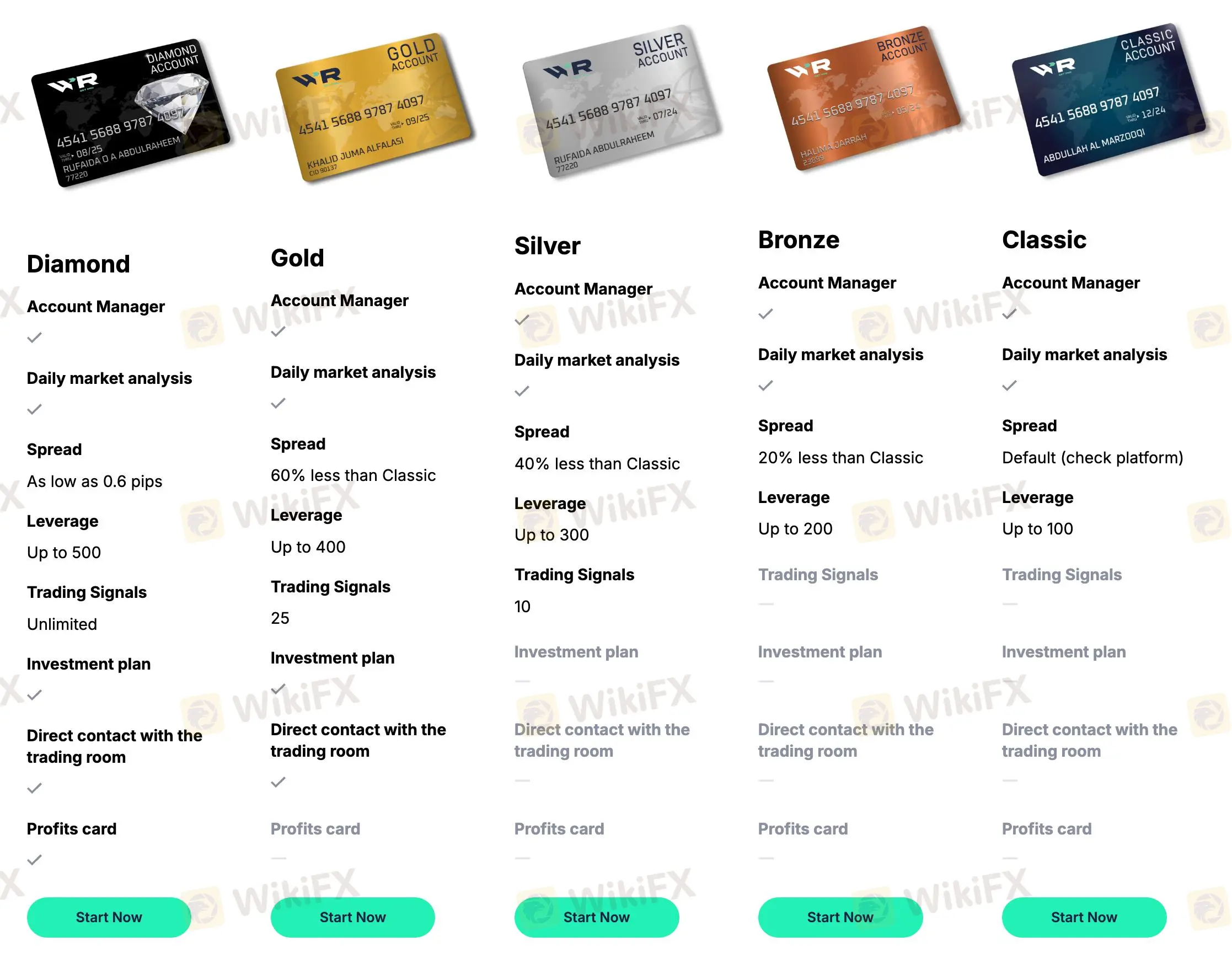

Account Types

Designed for traders with varying degrees of experience, WrPro provides five types live accounts—Diamond, Gold, Silver, Bronze, and Classic. They do not specifically mention Islamic account availability but demo account is available.

| Account Type | Spread | Leverage | Trading Signals | Suitable For |

| Diamond | As low as 0.6 pips | Up to 500 | Unlimited | Advanced traders requiring tight spreads and exclusive services |

| Gold | 60% less than Classic | Up to 400 | 25 | Experienced traders seeking premium features |

| Silver | 40% less than Classic | Up to 300 | 10 | Intermediate traders looking for better spreads |

| Bronze | 20% less than Classic | Up to 200 | None | Beginner traders with some experience |

| Classic | Default (check platform) | Up to 100 | None | New traders starting with basic account features |

Leverage

On Classic accounts, WrPro provides leverage ranging from up to 100x; on Diamond accounts, 500x. This gives traders flexibility to choose depending on their risk tolerance and trading plan.

WRC1 Fees

Trading fees at WRC1 are higher than typical, especially for entry-level accounts. Diamond accounts have 0.6-pip spreads, whereas Classic accounts have default, greater spreads. Example: Premium accounts can get EUR/USD spreads as little as 16 PIPS, whereas BTC/USD costs 4000 PIPS.

| Instrument | Spread (Pips) | Account Type |

| EUR/USD | 16 PIPS | Diamond/Gold Accounts |

| BTC/USD | 4000 PIPS | All Accounts |

| XAU/USD | 34 PIPS | Diamond/Gold Accounts |

| USD/JPY | 10 PIPS | Silver/Bronze Accounts |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for what kind of traders |

| iOS and Android Apps | ✔ | iOS, Android | Traders who need flexibility to trade on the go. |

| Intuitive Trading Platform | ✔ | Web-based, Desktop | Traders seeking a streamlined experience with real-time data and tools. |

Deposit and Withdrawal

WRC1 allows deposits and withdrawals with no specified fees, making it accessible for traders. The minimum deposit amount is 500 USD, while the minimum withdrawal amount is 50 USD.

| Payment Method | Type | Currency | Min. Deposit/Withdrawal | Fees/Commission | Processing Time |

| VISA/Mastercard/Maestro | Credit/Debit Card | EUR, USD | Deposit: 500 USD, Withdrawal: 50 USD | Free | Instant (Deposit) |

| Sofort/Trustly | Powercash | EUR, USD | Deposit: 500 USD, Withdrawal: 50 USD | Free | 1-2 Business Days |

| Wire Transfer | Wire Bank | USD, AED, SAR | Deposit: 500 USD, Withdrawal: 50 USD | Free | 1-3 Business Days |

| Apple Pay/Google Pay | EMV Payment | EUR, USD | Deposit: 500 USD, Withdrawal: 50 USD | Free | Instant (Deposit) |

Read more

COINEXX Review 2025: Is This Broker Safe or a Scam?

Choosing the right online broker is critical for the safety of your funds. COINEXX, established in 2018, presents itself as an ECN broker offering high leverage and low spreads. However, despite its claims of specialized trading services, the broker holds a concerningly low score on WikiFX, raising questions about its legitimacy.

Exness Review: Is the Low Score of 1.51 a Warning Sign?

When evaluating a forex broker, the safety of funds and regulatory standing are paramount. Exness (specifically the entity operating via premiumexness.com) presents a complex profile for traders to consider. Established fairly recently in 2020 and headquartered in Seychelles, this broker has attracted attention, but not necessarily for the right reasons.

Stockity Review 2025: Is It Safe to Trade or a Scam?

Stockity is an online brokerage firm established in 2022 and registered in the Marshall Islands. While it has established a marketing presence in regions such as Indonesia, South America (Argentina, Brazil, Colombia, Peru, Chile), and parts of Asia (India, Thailand), its regulatory standing raises significant concerns. With a WikiFX score of just 1.42 out of 10, Stockity is categorized as a high-risk entity due to the absence of valid regulatory licenses and multiple unresolved user complaints.

Strifor Review 2025: A Risk Analysis of This Unregulated Broker

Evaluating a broker’s safety requires a close look at its regulatory status, trading environment, and user feedback. Strifor is a brokerage firm established in 2022 with its headquarters in Mauritius. While it offers digital account opening and the popular MT5 platform, its low WikiFX score of 1.99 and regulatory status raise significant concerns.

WikiFX Broker

Latest News

Scam Victims Repatriated: Malaysia Thanks Thailand’s Crucial Help

XTB Review 2025: Pros, Cons and Legit Broker?

Cabana Capital Review 2025: Safety, Features, and Reliability

Why You’re a Millionaire on Demo but Broke in Real Life

Year of the Fire Horse 2026: Which Zodiac Signs Have the Strongest Money Luck in Trading?

Common Questions About OtetMarkets: Safety, Fees, and Risks (2025)

Phyntex Markets Review 2025: Safety, Fees, and User Complaints

JPMorgan Chase Eyes Crypto Trading for Institutional Clients

TigerWit Broker Review: Is TigerWit Legit or a Scam?

Voices of the Golden Insight Award Jury | Dennis Yeh, Head of Asia Pacific Region at Taurex

Rate Calc