LiteFinance Launches Powerful New Mobile Trading App

Abstract:LiteFinance launches its revamped mobile trading app in 2025, introducing real-time analytics, a sleek UI, and a $1M trading contest for users.

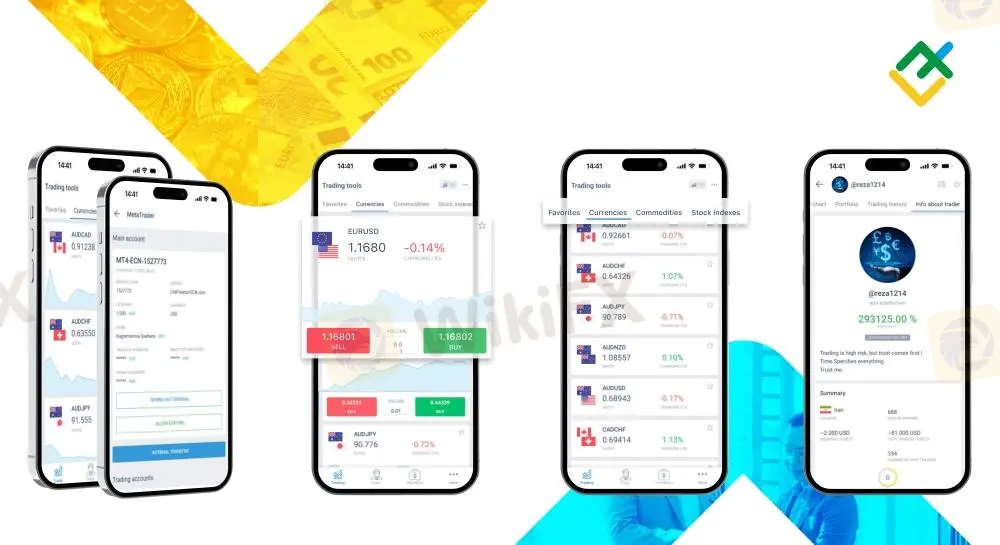

LiteFinance, a global leader in forex and cryptocurrency trading, has officially released its fully upgraded LiteFinance mobile trading app—designed to empower modern traders with speed, functionality, and intelligence. Now available on both the App Store and Google Play, the app is a keystone in LiteFinances strategy to redefine the mobile trading experience in 2025.

With sweeping improvements in user interface and performance, the LiteFinance app update 2025 delivers a smoother, smarter, and more responsive tool for navigating volatile financial markets. The update brings sleek mode switching, allowing users to tailor their experience based on account type and trading preference, while easily toggling between light and dark themes.

Enhanced Performance Meets Smart Analytics

As rival platforms compete for the of best forex trading app 2025, LiteFinance raises the bar with a comprehensive visual redesign and critical backend upgrades. Faster loading times, seamless chart rendering, and over 75 built-in technical indicators place traders at the forefront of market movements.

Perhaps the most game-changing aspect of the update is its integrated analytical package. Real-time data, expert insights, and actionable trading signals are now built directly into the app—eliminating the need for third-party analytics. Whether you're executing trades or analyzing trends, the cryptocurrency trading app LiteFinance offers a one-stop solution with over 300 instruments available, including copy trading capabilities and 24/5 customer support.

Adding to the momentum is LiteFinances celebration of its 20th anniversary with the launch of a global LiteFinance trading contest. The contest boasts a prize pool exceeding $1,000,000 and invites users to test-drive the app's new features while competing for high-stakes rewards.

This release underlines LiteFinance's commitment to innovation, driving accessibility and intelligence in trading technology. As mobile trading continues to shape the future of finance, this update secures LiteFinances place among the top contenders in the market for 2025 and beyond.

About LiteFinance

Founded in 2005, LiteFinance is a globally recognized broker offering forex and cryptocurrency trading solutions to retail and institutional clients across the globe. Known for its innovation, transparency, and trader-focused solutions, LiteFinance continues to shape the future of financial markets through technology and education.

Access the LiteFinance broker's page for more details: https://www.wikifx.com/en/dealer/6821266314.html

Read more

Is ZarVista Legit? A Critical Review of Its Licenses and Red Flags

For traders asking, "Is ZarVista legit?", the evidence points to a clear and strong conclusion: ZarVista operates as a high-risk broker. While it shows a modern interface and different account types, these features are overshadowed by major weaknesses in how it is regulated, a history of legal problems, and many user complaints. This article will break down these issues to give you a complete view of the risks involved. Our analysis shows that the chance of losing capital when dealing with ZarVista is very high. The combination of weak overseas licensing and documented problems creates a situation where trader funds are not properly protected.

AMarkets Licensing Details: What Their Offshore Regulation Really Means for You

When choosing a broker, the most important question is always: "Are my funds safe?" The answer depends on the broker's regulatory framework. For a company like AMarkets, which has been operating since 2007, understanding its licensing isn't just about checking a box. It's about understanding what that regulation truly means for your protection as a trader. This article provides a clear, detailed breakdown of AMarkets' licenses, what their offshore status really means, the extra safety measures it uses, and the risks you need to consider. We will go beyond marketing claims to give you factual, balanced information about their official licenses and other trust signals, helping you make a smart decision.

AMarkets Safety Review: Is Your Money Protected?

The question "Is AMarkets safe?" is the most important thing any trader can ask before investing. Putting your capital in a trading company requires a lot of trust, and the answer isn't simply yes or no. It's complicated and depends on understanding how the company works, what protections they have, and their past performance. To give you a clear answer, we've done a complete safety review of AMarkets. Our research looks at three main areas, each examining a different part of the company's safety. We'll share what we found using facts you can check, so you can make your own smart decision about whether your capital will be safe.

NPE Market Review: Why to Stay Away

NPE Market review shows blocked accounts, no regulation, and low trust—best to stay away.

WikiFX Broker

Latest News

Titan Capital Markets: The "Token" Trap Hiding Behind a Forex Mask

Stop Trading: Why "Busy" Traders Bleed Their Accounts Dry

Stop Chasing Green Arrows: Why High Win Rate Strategies Are Bankrupting You

Should You Delete Every Indicator from Your Charts? Let’s Talk Real Trading

Is ZarVista Legit? A Critical Review of Its Licenses and Red Flags

The Copycat Trap: Why You Lose Money Using a "Winning" Strategy

FIBOGROUP Investigation: When Revoked Licenses Meet Malicious Liquidation

Rate Calc