Common Questions About InstaForex: Safety, Fees, and Risks (2025)

Abstract:Finding a reliable broker is the most critical step in a trader's journey. With so many platforms promising high returns and low costs, it can be difficult to separate legitimate opportunities from dangerous traps. You are likely here researching InstaForex because their marketing caught your eye, but you want to ensure your capital is safe before depositing 1 cent.

Finding a reliable broker is the most critical step in a trader's journey. With so many platforms promising high returns and low costs, it can be difficult to separate legitimate opportunities from dangerous traps. You are likely here researching InstaForex because their marketing caught your eye, but you want to ensure your capital is safe before depositing 1 cent.

To give you an unbiased look at their current operations, we analyzed the data available on the WikiFX database. Unfortunately, the indicators are worrying. With a low WikiFX Score of 2.31 out of 10, InstaForex is currently flagged with significant trust issues that every potential user needs to understand before opening an account.

Is InstaForex actually regulated?

No, InstaForex does not have a verified, active regulatory license.

According to the latest regulatory data, InstaForex (operating as InstaFinance Ltd) claims to be domiciled in the Virgin Islands, but their status with the Virgin Islands Financial Services Commission (FSC) is listed as “Not Verified” or unauthorized.

Why does “Not Verified” matter?

Regulation is the only safety net a trader has. When a broker is regulated by a competent authority, they are legally required to segregate client funds from company operational funds. This means if the broker goes bankrupt, your money should theoretically remain safe.

An “Unverified” or unregulated status implies:

- No Fund Segregation: The broker could potentially use your deposits to pay their own bills or debts.

- No Dispute Resolution: If they refuse to process a withdrawal, you have no government ombudsman to complain to.

- Operation Risks: Without oversight, the broker makes their own rules regarding slippage, spreads, and leverage abuse.

Official Government Warnings

The regulatory situation for InstaForex is further complicated by official warnings. The Indonesian regulatory body, BAPPEBTI, has placed this entity on a warning list/blocklist (Disclosure code: 202305090812161898). The regulator specifically flagged entities like this for operating without a license and, in some cases, conducting operations that resemble “gambling under the guise of trading.” When a national government blocks a broker's domain to protect its citizens, it is a red flag that international traders should take very seriously.

What problems are users reporting?

While marketing materials often paint a perfect picture, user feedback tells the real story. We have analyzed recent complaints from verified users, and a disturbing narrative has emerged regarding withdrawal refusals and poor trading conditions.

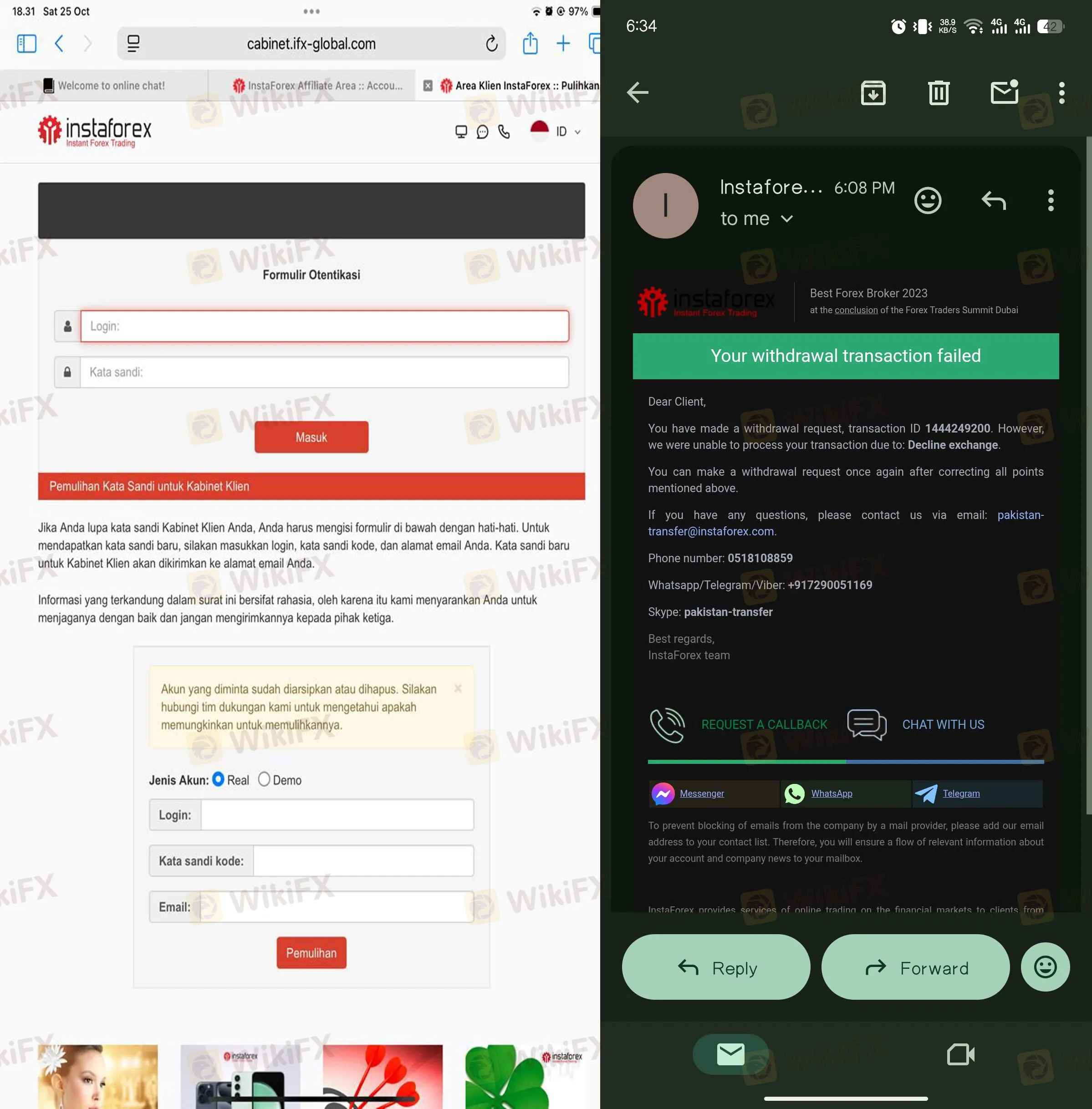

The “Deleted Account” & Withdrawal Nightmare

One of the most concerning reports comes from a user in Indonesia who attempted to use a “No Deposit Bonus” (NDB). After meeting all the lot size requirements and submitting a withdrawal request for $20, the request was canceled. When the user attempted to log in again to resolve the issue, they found their account had been deleted and archived without explanation.

This is a classic tactic used by unreliable platforms: they lure traders in with bonuses, but when it comes time to pay out profits, they simply sever the connection.

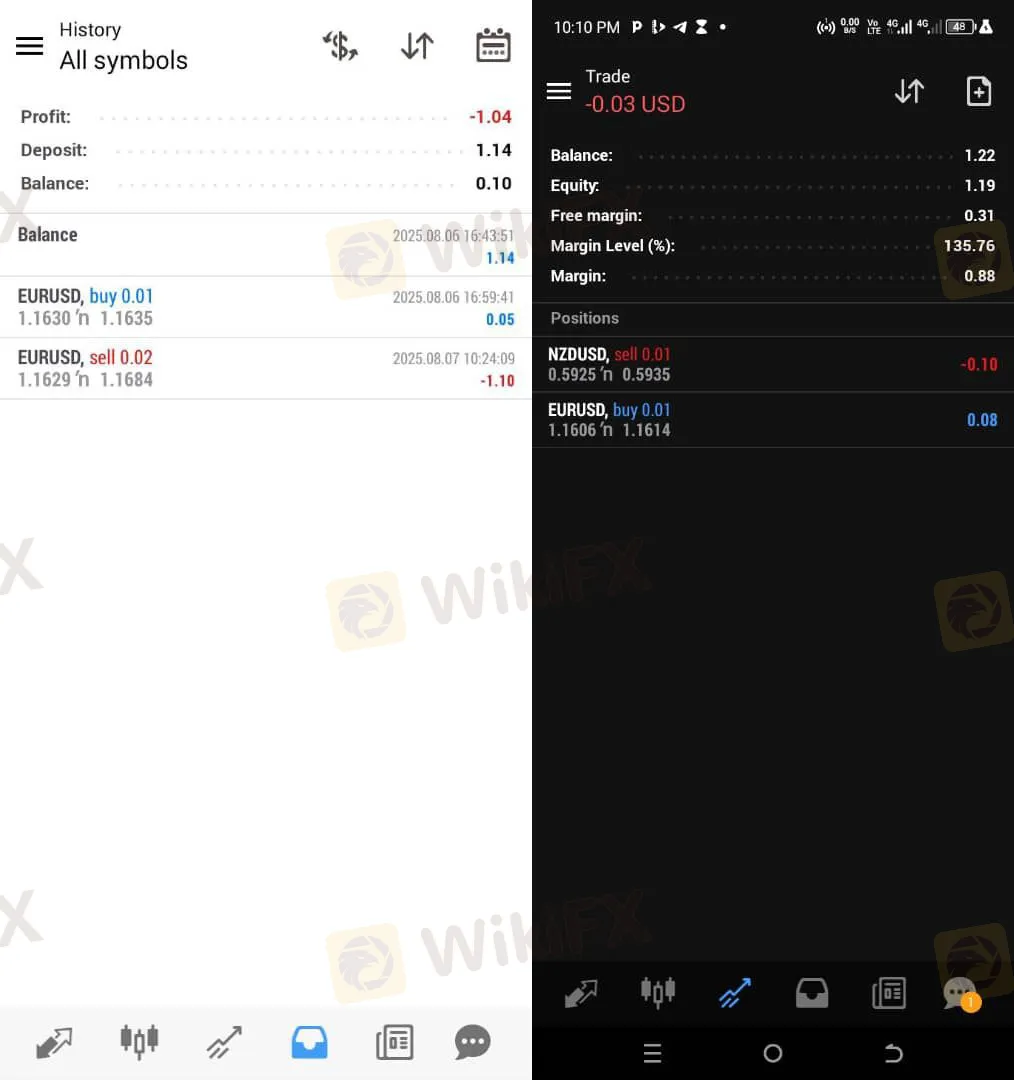

Unusable Spreads and Interfaces

Multiple users from the UK have reported that the trading conditions—specifically the spreads—make it nearly impossible to turn a profit. Traders noted that the spreads were so large that they faced immediate losses upon opening positions. One user mentioned they couldn't even hold a trade for “more than 5 minutes” before the costs ate their equity.

When spreads are artificially high, it suggests the broker might be profiting from your losses (acting as a “B-Book” market maker) rather than genuinely connecting you to the market.

Support That Ghosts You

Feedback from South Africa and New Zealand highlights a “terrible support experience.” Users reported receiving arbitrary decisions without logical explanations. In one instance, a response took 30 minutes in an “emergency” situation, which is unacceptable in the fast-paced world of Forex where seconds can mean the difference between profit and a margin call.

What trading conditions does InstaForex offer?

If you are willing to overlook the safety warnings, it is important to understand the mechanical risks of trading with InstaForex. Their trading conditions are structured in a way that encourages high-risk behavior.

Critical Leverage Risks

InstaForex offers leverage up to 1:1000.

While high leverage is often marketed as a tool to “get rich quick” with a small deposit, visually it functions more like a loan that can wipe out your account instantly. Legitimate regulators (like the FCA in the UK or ASIC in Australia) typically cap leverage at 1:30 for retail traders to protect them. A 1:1000 ratio means a 0.1% move against you can liquidate your entire balance. This level of leverage is almost exclusively found in offshore, unregulated brokerages.

Software and Accessibility

The broker utilizes the MT4 platform and lists a proprietary “self-developed” software. They offer multiple account types, including “Cent.Standard” and “Insta.Raw,” with entry barriers as low as $1.

However, there is a user experience gap here. The system summary notes a regret that the platform does not fully support iOS, Windows, or MacOS applications natively in some contexts, relying heavily on Android or web interfaces. For professional traders who rely on stable desktop environments, this lack of cross-platform robustness is a limitation.

Cost Structure

Although they advertise spreads “from 0” on certain accounts, the user complaints cited earlier suggest the reality is different. The “Standard” accounts show spreads starting from roughly 0.6 pips (or potentially higher depending on market volatility), but the user feedback about “large spreads” suggests that during live trading, these costs may balloon significantly.

Bottom Line: Should you trust InstaForex?

Based on the evidence, we do not recommend trading with InstaForex at this time.

The combination of a low 2.31 score, an unverified regulatory status in the Virgin Islands, and active government blocklists in Indonesia creates a high-risk environment for your funds. The specific user reports of accounts being deleted upon withdrawal requests are particularly damning.

There are hundreds of brokers who hold valid licenses from top-tier authorities like the FCA or ASIC, ensuring your funds are segregated and protected. There is simply no need to take the risk with an unregulated entity.

Markets change fast. Licenses can be revoked or reinstated overnight. To verify the current license status of this broker or to find safer alternatives, search for InstaForex on the WikiFX App.

Read more

United Broker Exposure: Withdrawal Issues and Unjust Fees Reported

Is your fund withdrawal request pending with the United broker for a long time? Has the UK-based forex broker still not resolved your withdrawal issues? Does the broker demand multiple fee payments every time you seek withdrawals? Is the United customer support team inept in handling your trading queries efficiently? You are not alone! Many traders have made their displeasure known on several broker review platforms such as WikiFX. In this United review article, we have investigated several complaints against the broker. Take a look!

Leo Review: Allegations of Profit Reversals & Weak Customer Support

Is your forex trading experience with Leo no short of a financial disaster? Does the Hong Kong-based forex broker deliberately cancel your profits when asking for withdrawals? Do you frequently encounter the issue of a NIL forex trading account balance? Does the Leo customer support team fail to resolve your trading queries? In this Leo review article, we have investigated many complaints against the broker. Take a look!

HIJA MARKETS User Reputation: Is It Safe or a Scam? An Evidence-Based Analysis

Is HIJA MARKETS safe or a scam? This is the key question for any trader thinking about using this platform, and our research aims to give a clear, fact-based answer. Based on proven information, Hija Markets shows several major warning signs that require serious caution. The platform started very recently in late 2024, has no financial oversight, and barely exists online - these are huge red flags. This article will examine these issues to show the possible risks to your capital. We will look at the company's background, rules it follows, and how open it is about its business. Before investing with any broker, checking it independently is essential for safety. We strongly suggest using a complete platform, such as WikiFX, to check a broker's legal status and user reviews as your first step.

HIJA MARKETS Regulation: A Complete Guide to Understanding Its Unregulated Status

s Hija Markets regulated? After checking official regulatory databases, we can confirm that Hija Markets is not a regulated broker. The company, Hija Global Markets Ltd, is registered as an International Business Company (IBC) in Saint Lucia. However, being registered as a business is very different from having a financial license that allows them to handle your capital for trading. Without a license from a recognized financial authority, there is no regulatory oversight, no protection for your capital, and no required process for resolving disputes. This article will explain the evidence behind this conclusion, show you the serious risks involved, and give you a clear guide on how to check this information for any broker. Before choosing any broker, especially one with warning signs like these, an important first step is to check its profile on a verification platform, such as WikiFX, to get the complete picture.

WikiFX Broker

Latest News

Gold Fun Corporation Ltd Review: A Deep Dive into Safety and Regulation

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Gold Tears Through $4,700 Barrier as Risk Premiums Spike

Rate Calc