HIJA MARKETS Review 2026: Unregulated Broker with Major Red Flags?

Abstract:Hija Markets is a new online trading company that started in 2024. It is run by a company called Hija Global Markets Ltd. Our research shows that while the company is registered as a business in Saint Lucia, it is not regulated by any financial authority. This one fact immediately raises serious questions about whether client capital is safe here. This review will carefully examine every aspect of Hija Markets, from what it promises to offer to the major warning signs we found, to help you understand the big risks before you invest here.

Is Hija Markets Safe?

Hija Markets is a new online trading company that started in 2024. It is run by a company called Hija Global Markets Ltd. Our research shows that while the company is registered as a business in Saint Lucia, it is not regulated by any financial authority. This one fact immediately raises serious questions about whether client capital is safe here. This review will carefully examine every aspect of Hija Markets, from what it promises to offer to the major warning signs we found, to help you understand the big risks before you invest here.

Why This Review Matters

Picking a broker is one of the most important decisions a trader can make. A well-regulated broker must follow strict rules that protect your capital and make sure trading is fair. An unregulated one works in a gray area with no such protections.

The goal of this article is to give you a complete, fact-based analysis using public information, our own tests of their platform, and industry knowledge. We present the facts so you can make a fully informed and, most importantly, safe decision for your financial future.

The Critical Issue: Regulation

Registration vs Regulation

You need to understand the difference between a company being registered and being regulated. Hija Markets heavily promotes that it's registered as an International Business Company (IBC) in Saint Lucia, with registration number 2024-00762. We confirmed that Hija Global Markets Ltd. is indeed listed in the Saint Lucia International Business Company registry.

However, an IBC registration is just a business setup process. It's like registering a business name and has nothing to do with financial supervision, oversight, or investor protection.

The group responsible for financial oversight in Saint Lucia is the Financial Services Regulatory Authority (FSRA). Our check of the FSRA's public register shows no regulatory license for Hija Markets or its parent company, Hija Global Markets Ltd. This means it is not authorized to provide financial services and is not monitored by any official body.

What “Unregulated” Means

Trading with an unregulated broker like Hija Markets exposes you to serious and unavoidable risks. The consequences for you as a trader include:

· No Fund Protection: Regulated brokers must keep client funds in separate accounts, away from company business funds. This ensures your fund isn't used for the broker's business expenses and is protected if the company goes bankrupt. With Hija Markets, there is no such guarantee.

· No Dispute Resolution: If you have a problem, such as a withdrawal request being denied or a dispute over how a trade was handled, there is no official regulatory body to appeal to. You are left to deal with the company directly, with no power or options.

· Risk of Fraud: Without a regulator to enforce rules of conduct, the broker can operate without following fair trading practices. This can include price manipulation, unfair closing of positions, and other fraudulent activities.

The lack of a credible license is the biggest warning sign. Before considering any broker, especially a new one, you must verify its regulatory status on a trusted third-party platform. We strongly recommend checking the Hija Markets profile on WikiFX to see its full regulatory breakdown and risk assessment.

Red Flag Analysis

Beyond the critical lack of regulation, our investigation found several other warning signs that point to a high-risk operation. These red flags, when viewed together, paint a troubling picture of the broker's legitimacy and transparency.

A New, Untracked Operation

According to Whois data, the broker's official website, `hijamarkets.com`, was only registered on December 4, 2024. With the current date being early 2026, this means the entire operation has existed for a little over a year.

In the financial industry, a track record is extremely important. Such a short operational history is a major risk factor. It shows a lack of stability, no long-term presence in the market, and no history of reliably processing client withdrawals over time. New brokers are often the highest risk, as they have not yet proven their longevity or integrity.

Invisibility and Lack of Transparency

For a modern financial services company, transparency is key to building trust. Hija Markets shows a significant lack of it in several areas:

· No Social Media Presence: Our search found that Hija Markets has zero presence on major platforms such as Facebook, Twitter, LinkedIn, or Instagram. This is highly unusual. Reputable brokers use social media for market updates, client engagement, and public accountability. A complete absence suggests an effort to avoid public scrutiny.

· Low Website Traffic: Data from online analytics tools, such as Semrush, shows the broker's website receives very few monthly visits (fewer than 200). This indicates a very small user base and extremely low market recognition, suggesting it is not a widely trusted or used platform.

· Unverifiable Office: The company lists a physical office address in Dubai (Office 2013, The Binary by Omniyat, Business Bay). However, we could find no independent, third-party verification that Hija Markets maintains a physical staff or operational presence at this location.

Unresponsive Customer Support

A broker's customer support is your lifeline when issues arise. To test their effectiveness, we conducted a simple but revealing test.

We sent a test inquiry to its official support email (`support@hijamarkets.com`) asking a basic question about its account services. As of the time of this writing, more than 72 hours later, we have received no response.

Unresponsive support during the initial evaluation phase is a strong negative indicator. If a potential new customer cannot get a reply, it is highly unlikely that an existing client facing a critical issue, such as a withdrawal problem, will receive timely or effective assistance.

What Hija Markets Offers

To provide a complete picture, we must also look at what Hija Markets claims to offer its clients. While some features may seem attractive on the surface, they must be considered within the context of the significant risks already highlighted.

Trading Instruments

Hija Markets advertises a diverse range of tradable assets, which is standard for most online brokers today. The available classes include:

· Forex

· Stocks

· Spot Metals

· Cryptocurrencies

· Commodities

While this is a comprehensive selection, the ability to trade these assets safely and fairly depends entirely on the integrity and reliability of the broker, which, in this case, is highly questionable.

Account Types Breakdown

The broker offers four main account types, seemingly catering to different levels of traders. The low minimum deposits are often used by new brokers to attract unsuspecting beginners.

| Account Type | Min. Deposit | Spreads From | Commission | Max. Leverage | Key Feature |

| Standard | $50 | 1.5 pips | $0 | 1:500 | All-rounder for beginners |

| Prime | $1,000 | 0.6 pips | $0 | 1:500 | For higher-volume traders |

| Raw Spread | $500 | 10.0 pips | $3/lot | 1:500 | For ECN-style trading |

| LeveragePlus | $10 | 1.8 pips | $0 | 1:2000 | For high-risk, low-capital tests |

An Islamic Account option is also mentioned, but the website provides no detailed information on its specific conditions. The advertised spreads and commissions should be viewed with skepticism, as unregulated brokers are not bound to honor these quotes.

Platform and Tools

Hija Markets claims to offer the globally recognized MetaTrader 5 (MT5) platform, known for its advanced charting tools and support for automated trading.

However, we identified a major discrepancy: the official Hija Markets website does not provide a download link for the MT5 platform. This is a significant omission. Furthermore, while our team was able to find a server named “Hija Global Markets Ltd.” within the MT5 application's server list, its legitimacy and proper integration with the broker's infrastructure are unclear. This raises further questions about the broker's technical competency and transparency.

A broker's platform is its core product. Discrepancies, such as a missing download link, should be a cause for concern. You can often find user feedback on platform stability and other operational details on verification sites such as WikiFX.

HIJA MARKETS Pros and Cons Summary

To directly address the search for HIJA MARKETS Pros and Cons, here is a summary. It is critical to note that the “cons” represent fundamental risks to your capital, while the “pros” are merely advertised features.

| Pros (Advertised Features) | Cons (Critical Risks) |

| ✅ Diverse range of trading products. | ❌ CRITICAL: No financial regulation. |

| ✅ Multiple account types with low entry points. | ❌ Extremely new company with no history (domain from late 2024). |

| ✅ Claims to support the popular MT5 platform. | ❌ Complete lack of social media and public transparency. |

| ✅ Wide variety of deposit/withdrawal methods. | ❌ Failed customer support test (unresponsive email). |

| ✅ Simple registration process and clean website. | ❌ Missing MT5 download link and unclear platform integration. |

Weighing the Balance

When you weigh these points, the conclusion is clear. The “pros” listed are standard features that you can find at hundreds of other brokers, many of whom are fully regulated by top-tier authorities. The “cons,” on the other hand, are not minor inconveniences. They are fundamental issues that directly compromise trader safety, fund security, and the potential for fair dealing. The risk of losing your entire investment far outweighs any advertised benefit.

Your Action Plan

This HIJA MARKETS Review serves as a case study in why due diligence is essential. To empower you to avoid risky brokers in the future, here is a simple, actionable framework to verify any broker before you invest.

Step 1: Prioritize Regulation

This is the first and most important step. Never take a broker's claims about its regulatory status at face value. Always verify it yourself.

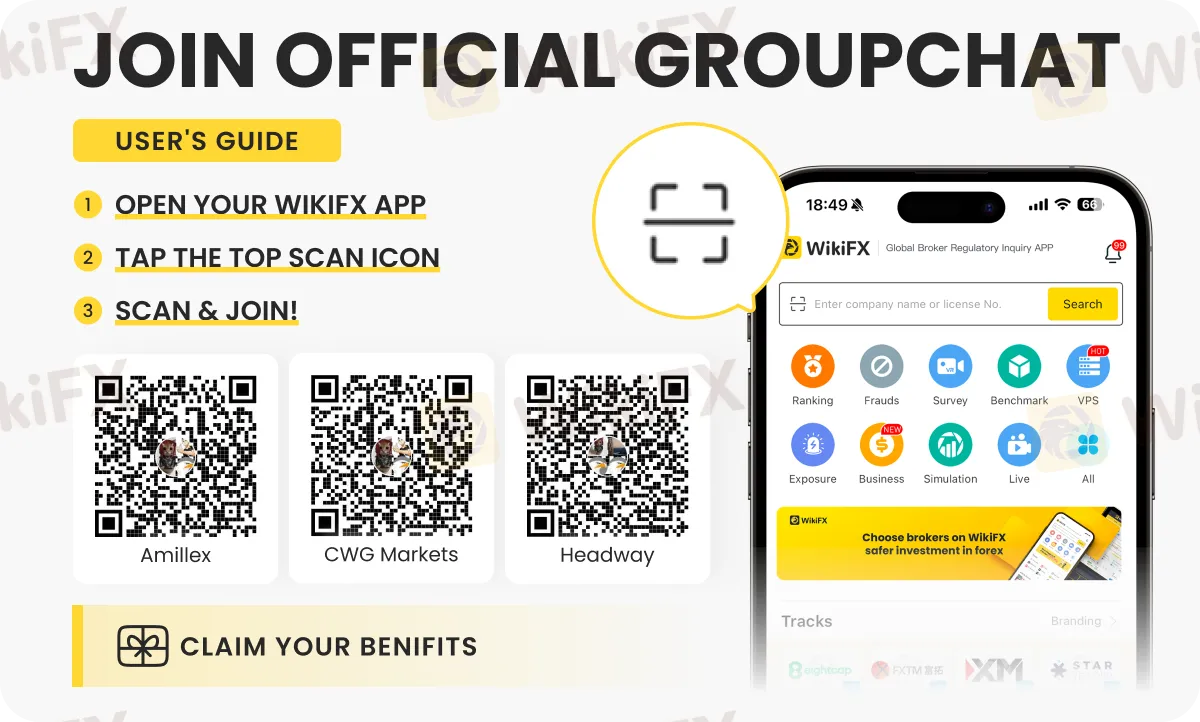

Instead of manually checking multiple regulatory websites, which can be confusing, use a comprehensive verification tool. Go to WikiFX and type the broker's name into the search bar. It aggregates data from regulators worldwide and provides a clear safety score and license details in one place. If a broker is not listed with a reputable regulator, stop and go no further.

Step 2: Investigate History

A broker's reputation is built over years, not months. Investigate its background with these checks:

· Domain Age: Use a free Whois lookup tool online to check the website's registration date. A history of less than 2-3 years is a significant warning sign.

· User Reviews: Look for independent reviews on trusted forums and websites. Be wary of overly positive testimonials on the broker's own site. Focus on what real users are saying about withdrawals and customer support.

· Online Presence: Check for active, professional social media accounts. A legitimate company will have a public-facing presence and engage with its community.

Step 3: Test the Platform

Before committing any significant capital, conduct your own tests:

· Never deposit a large sum initially. If you decide to proceed after all other checks, start with the absolute minimum amount.

· Test its customer support *before* you deposit. Send a simple question via email or live chat, as we did in this review. Its response time and quality will tell you a lot about its professionalism.

Conclusion: The Final Verdict

To summarize our findings, Hija Markets is an unregulated, newly established online entity with multiple operational red flags. These include a complete lack of transparency, an unproven track record, and non-responsive customer support.

While it advertises a range of attractive features such as diverse products, high leverage, and low minimum deposits, these are completely overshadowed by the fundamental and unacceptable risks posed to trader capital. Without regulatory oversight, there is no protection for your funds and no guarantee of fair practice.

Based on our comprehensive review of the available facts, we cannot recommend Hija Markets. The level of risk involved is far too high for any trader, whether beginner or experienced.

Protect your investment. Always choose brokers with top-tier regulation from reputable authorities such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus), and a proven track record of reliability. Use tools such as WikiFX to conduct thorough due diligence before depositing funds.

Want regular forex updates, tips, strategies and insights? Join these special chat groups - OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G - where our industry experts equip you with the same.

Read more

United Broker Exposure: Withdrawal Issues and Unjust Fees Reported

Is your fund withdrawal request pending with the United broker for a long time? Has the UK-based forex broker still not resolved your withdrawal issues? Does the broker demand multiple fee payments every time you seek withdrawals? Is the United customer support team inept in handling your trading queries efficiently? You are not alone! Many traders have made their displeasure known on several broker review platforms such as WikiFX. In this United review article, we have investigated several complaints against the broker. Take a look!

Leo Review: Allegations of Profit Reversals & Weak Customer Support

Is your forex trading experience with Leo no short of a financial disaster? Does the Hong Kong-based forex broker deliberately cancel your profits when asking for withdrawals? Do you frequently encounter the issue of a NIL forex trading account balance? Does the Leo customer support team fail to resolve your trading queries? In this Leo review article, we have investigated many complaints against the broker. Take a look!

HIJA MARKETS User Reputation: Is It Safe or a Scam? An Evidence-Based Analysis

Is HIJA MARKETS safe or a scam? This is the key question for any trader thinking about using this platform, and our research aims to give a clear, fact-based answer. Based on proven information, Hija Markets shows several major warning signs that require serious caution. The platform started very recently in late 2024, has no financial oversight, and barely exists online - these are huge red flags. This article will examine these issues to show the possible risks to your capital. We will look at the company's background, rules it follows, and how open it is about its business. Before investing with any broker, checking it independently is essential for safety. We strongly suggest using a complete platform, such as WikiFX, to check a broker's legal status and user reviews as your first step.

HIJA MARKETS Regulation: A Complete Guide to Understanding Its Unregulated Status

s Hija Markets regulated? After checking official regulatory databases, we can confirm that Hija Markets is not a regulated broker. The company, Hija Global Markets Ltd, is registered as an International Business Company (IBC) in Saint Lucia. However, being registered as a business is very different from having a financial license that allows them to handle your capital for trading. Without a license from a recognized financial authority, there is no regulatory oversight, no protection for your capital, and no required process for resolving disputes. This article will explain the evidence behind this conclusion, show you the serious risks involved, and give you a clear guide on how to check this information for any broker. Before choosing any broker, especially one with warning signs like these, an important first step is to check its profile on a verification platform, such as WikiFX, to get the complete picture.

WikiFX Broker

Latest News

Gold Fun Corporation Ltd Review: A Deep Dive into Safety and Regulation

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Gold Tears Through $4,700 Barrier as Risk Premiums Spike

Rate Calc