London Holds Firm as Global FX Hub, Handling 38% of Worldwide Trading

Abstract:London continues to dominate the global forex market with nearly 38% of total trading volume, making it a key hub for currency pricing and liquidity for brokers and traders worldwide.

London continues to dominate the global foreign exchange market, accounting for around 38% of total FX turnover worldwide, reaffirming its position as the most important pricing and liquidity center for currencies despite shifting global trade patterns and rising geopolitical uncertainty.

Industry data show that more US dollars are traded in the UK than in the United States itself, a statistic that highlights how deeply embedded London remains in the infrastructure of global currency markets. From interbank trading to institutional hedging and prime brokerage services, much of the worlds FX flow still routes through London-based systems.

Why London Still Matters for FX Pricing

For large banks, hedge funds, and liquidity providers, London offers a unique combination of deep liquidity, time-zone overlap with both Asia and North America, and long-established trading networks. This allows price discovery to remain highly efficient, particularly during the European session when global participation is at its peak.

London also plays a leading role in offshore renminbi trading, processing over 40% of global offshore RMB transactions, making it a critical bridge between Asian currency flows and Western financial institutions.

For forex brokers and CFD platforms, this concentration of liquidity affects everything from spreads and execution speed to hedging strategies. When major pricing engines or liquidity hubs in London experience disruptions, the impact is often felt quickly across retail trading platforms worldwide.

Spillover Effects Across Related Markets

Although FX remains the core focus, London‘s broader financial ecosystem supports currency trading in several ways. The UK is one of the world’s largest centers for cross-border banking, providing funding channels and derivatives clearing services that underpin FX swap and forward markets.

Insurance, capital markets, and fintech also play supporting roles by supplying technology, risk transfer mechanisms, and payment infrastructure that facilitate international currency flows. These sectors do not drive FX volumes directly, but they strengthen the operational backbone that keeps the market functioning smoothly.

Resilience Amid Global Uncertainty

Recent years have brought heightened volatility, trade disputes, and regional financial fragmentation. Yet Londons share of global FX trading has remained relatively stable, suggesting that market participants continue to prioritize depth of liquidity and operational reliability over geographic diversification alone.

While regional hubs in Asia and the Middle East are expanding, they currently complement rather than replace Londons role in global price formation. For now, the core of global currency trading remains tightly anchored in the UK capital.

What This Means for Forex Market Participants

For brokers, proprietary trading firms, and institutional desks, Londons dominance translates into continued reliance on UK-based liquidity pools and pricing feeds. This makes regulatory stability, data center resilience, and financial infrastructure in the region especially relevant to global trading operations.

For retail traders, it helps explain why major market moves often accelerate during European trading hours and why disruptions affecting UK-based market infrastructure can ripple through platforms worldwide.

As global FX volumes continue to grow, Londons central role suggests that, despite political and economic shifts, the structure of currency markets remains anchored in long-established financial hubs rather than rapidly relocating to new centers.

Read more

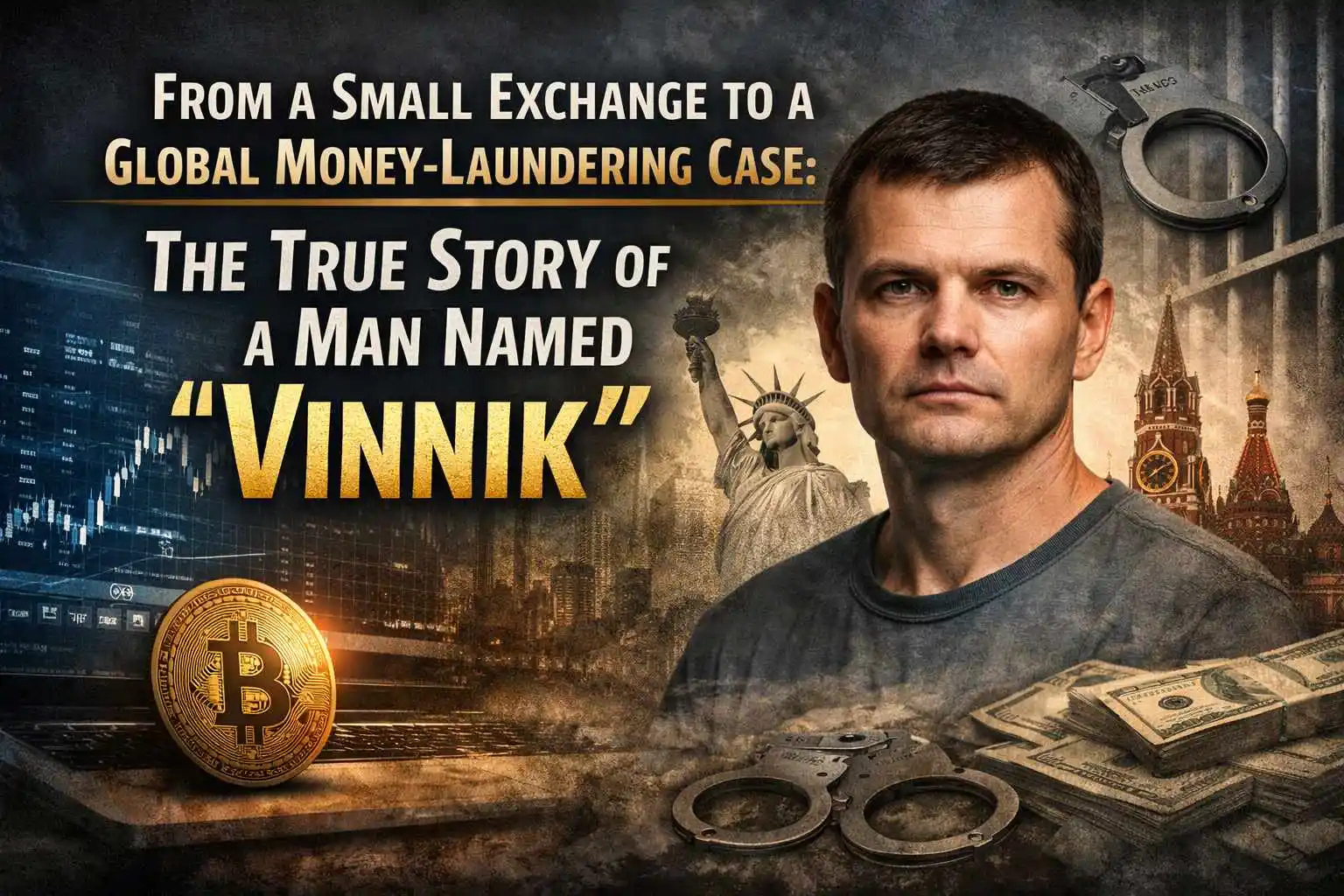

From a Small Exchange to a Global Money-Laundering Case: The True Story of a Man Named “Vinnik”

The name BTC-e is one of the most talked-about in cryptocurrency history—not because it was innovative, but because it became a symbol of the “dark side” of digital assets. Recently, this story has resurfaced after Alexander Vinnik, a man widely seen as the owner and operator of BTC-e, was released from a U.S. prison and returned to Russia as part of a government prisoner swap.

Gold Price Surges Above $4,600 as Fed Rate-Hold Bets Offset Fading Safe-Haven Demand

Gold prices climb above $4,600 after rebounding from recent losses. US jobless claims reinforce Fed rate-hold expectations, while easing geopolitical tensions limit safe-haven demand.

Inside the Elite Committee: Talk with LadyChiun

WikiFX has launched the “Inside the Elite” Interview Series, featuring outstanding members of the newly formed Elite Committee. During the committee’s first offline gathering in Dubai, we conducted exclusive interviews and gained deeper insights into regional market dynamics and industry developments. Through this series, WikiFX aims to highlight the voices of professionals who are shaping the future of forex trading — from education and compliance to risk control, technology, and trader empowerment.

Welcome Aboard – Your Exclusive Trading Community Awaits

Hi there, new friend! Welcome to a space that truly belongs to traders. Here, information isn’t just in the charts – it’s in real conversations.

WikiFX Broker

Latest News

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Gold Tears Through $4,700 Barrier as Risk Premiums Spike

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

IVY MARKETS Exposure: Traders Allege Illegitimate Fees, Blocked Withdrawal Orders & No Refunds

Rate Calc