WikiFX Exposure: Is Capex Broker Safe? The "Bonus" Trap and Withdrawal Blockade

Abstract:Our investigation into Capex reveals severe anomalies, including blocked withdrawals and aggressive retention tactics. With 10 complaints in just three months and confirmed reports of platform access failures, the safety of client funds is currently at critical risk.

Investigation Date: October 2025

Subject: Capex Broker Review

Risk Level:Critical

Our investigation reveals a disturbing pattern of behavior at Capex. While the broker claims legitimate status, a flood of recent user reports paints a picture of aggressive account managers, system lockouts, and conditional withdrawals. If you are trading Forex or considering this platform, this report is your urgent safety briefing.

The “Imbecile” Incident: A Trader's Nightmare

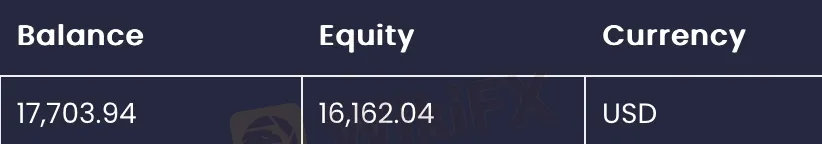

The most damning evidence comes from a verified user in Mexico who attempted to withdraw funds in April 2025. After depositing $5,700 and growing the account to over $24,000, the user was blocked from withdrawing.

According to the complaint, an advisor named Emanuel resorted to verbal abuse, calling the client an “imbecile” and demanding a nonsensical $25,000 additional deposit just to unlock the existing funds. This is not the behavior of a legitimate Capex broker representative; it is a hallmark of a capital extraction trap.

Capex Regulation and Safety Audit

Before trusting a broker with your identity and capital, you must verify who—if anyone—is watching them. Our audit of the Capex regulation status uncovers significant gaps.

| Regulator | License Type | REAL STATUS |

|---|---|---|

| CySEC (Cyprus) | STP/Market Maker | Regulation in Progress / Active |

| FSCA (South Africa) | Financial Service Provider | Unverified (High Risk) |

| FSA (Seychelles) | Offshore | Offshore Regulation |

Investigator's Note: While the CySEC license appears valid for Key Way Investments, the Unverified status with South Africa's FSCA is a major red flag. Furthermore, the reliance on offshore regulation in Seychelles often leaves traders with little legal recourse if funds disappear.

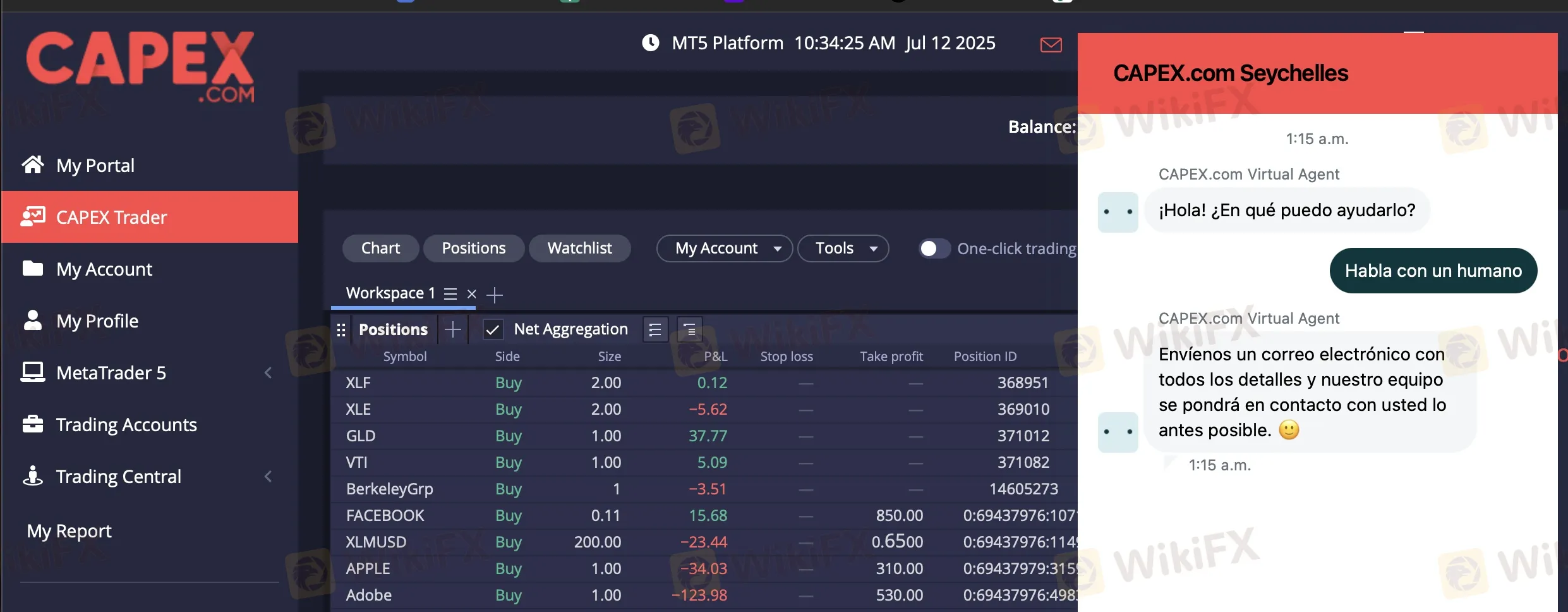

The “Update” Excuse: Capex Login Issues Exposed

A critical failure point for any online trader is platform reliability. In March 2025, a user reported that the Capex login portal was inaccessible for several days due to a “supposed update.”

- The Glitch: The web platform went down during volatile market hours.

- The App: The user reported the Android app had been non-functional for two months.

- The Consequence: Traders with open positions were unable to manage risk, leading to inevitable losses. When support was contacted, they allegedly provided no resolution.

The “Bonus” Trap: Why You Can't Withdraw

Multiple cases (including Case 2 and Case 6) highlight a systemic issue with “Bonuses.” Advisors like Jaison Sanchez and Herson Sánchez are frequently named in complaints. The tactic is consistent:

1. Inducement: Advisors pressure clients to take a “bonus” to increase buying power.

2. The Lock: When a user tries to withdraw, the broker cites obscure terms requiring impossible trading volumes (e.g., “75% of bonus complete”).

3. The Pressure: Advisors demand more deposits to “protect” positions or “maximize” the bonus, effectively holding the original capital hostage.

One user in Honduras (Case 3) reported that advisor Giselle Gerrero Gómez coerced them into injecting more money under the threat that the entire portfolio would be liquidated otherwise.

Key Red Flags Identified

- 10 verified complaints received by WikiFX in the last 3 months.

- Withdrawal denials linked to aggressive “bonus” terms.

- Unverified regulatory status for specific regional entities (FSCA).

- Specific Advisors Named: Jaison Sanchez, Emanuel, Giselle Gerrero Gómez.

Verdict

Is Capex a safe environment for Forex trading? The evidence suggests a severe risk to retail clients. The combination of abusive advisor conduct, unverified regulatory licenses in key regions, and confirmed Capex login failures creates a dangerous environment for your funds.

We strongly advise users to avoid depositing further capital until unresolved withdrawal complaints are cleared.

WikiFX Score: 5.30 (Declining)

Status:User Complaints Surge - Be Vigilant

WikiFX Broker

Latest News

If you haven't noticed yet, the crypto market is in free fall, but why?

Gold Rally Validated as Miners Forecast Doubled Earnings

Renewable Grid Integration: Economics and Technology

US Labor Market 'Noise' vs. Reality; Trump Trade Agenda Looms Over Outlook

Emerging Markets: Nigeria's Debt Market Valuation Hits N99.3 Trillion

JPY In Focus: Takaichi Wins Snap Election to Become Japan's First Female Leader

Central Bank Divergence: BoE Dovish Tilt Pressures Sterling as Global Policy Paths Fork

Bitcoin Reclaims $71,000: Volatility as a Proxy for Global Risk Appetite

Emerging Markets: Naira Strengthens Against Euro as FDI Pledges Bolster Sentiment

WikiFX Elite Club Focus | Jimmy: Trust is the Most Valuable Asset

Rate Calc