Why Opofinance’s Dual Licensing Looks Weak, Not Reassuring

Abstract:Opofinance holds only an offshore Seychelles FSA license and an ASIC investment advisory license (402043) that explicitly excludes forex trading. Learn what this means for your money before trading.

Understanding Opofinance Regulation

Opofinance markets itself as a globally regulated forex and CFD broker, but a closer look at its regulatory structure reveals a framework far less robust than many traders might expect.

Behind the reassuring headlines about multiple licenses, Opofinance relies mainly on an offshore authorization in Seychelles and an Australian license that is limited to investment advisory services rather than actual forex trading.

For anyone searching “Opofinance Regulation,” the key question is not whether the word “regulated” appears on the website, but which specific activities each license covers, which entity holds your funds, and what real protections are available if something goes wrong.

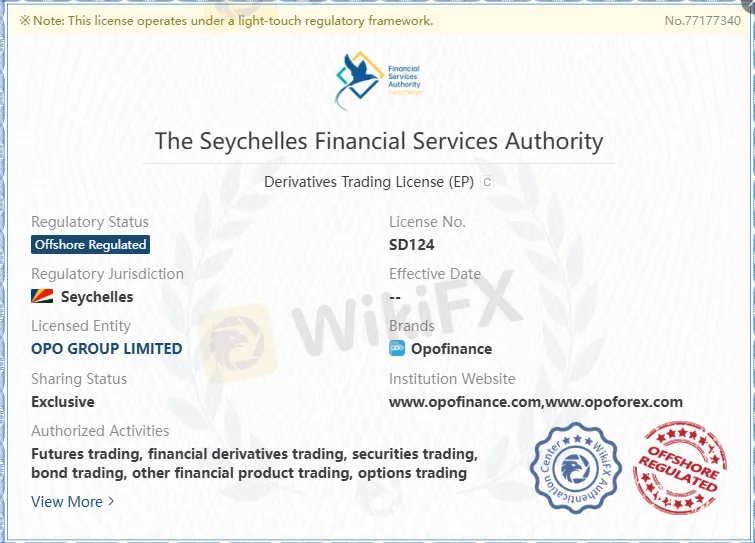

The Seychelles FSA License: Offshore and High‑Risk

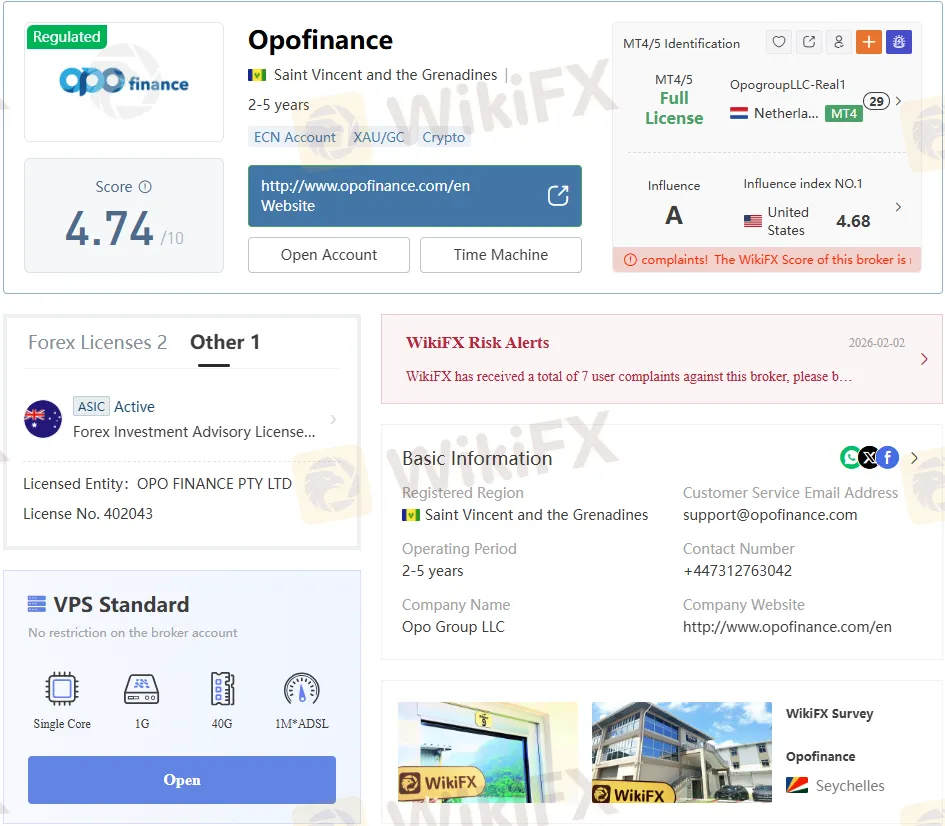

Opofinance is operated offshore through Opo Group Ltd, a company registered in Seychelles. The WikiFX profile shows that this entity holds a Retail Forex License issued by the Seychelles Financial Services Authority (FSA) under license number SD124 and is clearly labeled “Offshore Regulated.”

Offshore regulation typically involves lighter oversight, lower capital requirements, and fewer restrictions on leverage, which can expose retail clients to higher operational and trading risks. In Opofinances' case, leverage on some account types reaches 1:2000, a level that regulators in stricter jurisdictions usually consider unsafe for ordinary traders.

ASIC License 402043: Advisory Only, Not Forex Trading

The second part of Opofinances dual‑license story is the Australian license held by OPO FINANCE PTY LTD. The document shows a “Forex Investment Advisory License (IA)” with license number 402043, issued under the Australian Securities & Investment Commission (ASIC). At the top, a crucial note is clearly printed: “This license does not authorize forex trading.”

The authorized activities listed include foreign exchange investment consulting, financial derivatives investment consulting, and securities investment consulting, but not the actual provision of leveraged forex trading services to clients. In other words, the ASIC authorization is limited to advisory‑type services and explicitly excludes the core product that many traders assume is covered when they see an Australian license attached to the Opofinance brand.

Why the Dual Licensing Looks Weak, Not Reassuring

When you combine an offshore Seychelles license with an Australian advisory license that does not permit forex trading, the image of “strong dual regulation” starts to crumble. The operational trading risk for most retail clients appears to fall under the offshore FSA license, while the ASIC license primarily covers investment consulting and includes a prominent restriction on forex dealing.

This mismatch can create a dangerous perception gap: traders may feel comforted by seeing “ASIC” on marketing materials, yet their accounts and trades may actually be governed only by the lighter offshore framework. From a risk perspective, the structure relies heavily on a jurisdiction where enforcement may be more limited, and compensation schemes or robust dispute‑resolution mechanisms may be weaker or absent.

High Leverage and Limited Protection

The combination of high leverage and offshore regulation is another reason Opofinance regulation deserves close scrutiny. With leverage advertised up to 1:2000 on some account types, a small market move can wipe out an account in seconds, especially for inexperienced traders. Regulators in Europe, the UK, and Australia often cap retail leverage at far lower levels precisely to protect clients from these outcomes.

In a less stringent oversight setting, issues such as slippage, execution quality, and potential conflicts of interest may be harder to challenge. If a dispute arises over order handling or withdrawals, a client relying on an offshore FSA framework may find that available remedies are far more limited than those provided by higher‑tier regulators, despite the presence of an ASIC-licensed entity within the group structure.

What On‑Site Checks Reveal About Opofinance Offices

A physical office does not guarantee fair treatment, but it can help confirm that a broker is more than a shell. A recent survey report states that a team visited Opofinance's regulatory address in Seychelles: “CT House, Office 9D, Providence, Mahe.” The investigators located the building and found the door marked with the company name “Opo Group Ltd,” confirming that a physical office exists at the stated address.

The same report concludes that the broker maintains a business presence at that location but advises investors to consider all factors before deciding to trade. An office sign and a doorbell do not change the underlying regulatory structure: client trading risk still appears concentrated in the offshore entity, and the ASIC license remains restricted to advisory activities rather than full‑scale forex dealing.

Last Exposure Case and Ongoing Warnings

Recent exposure articles and broker reviews highlight the regulatory weaknesses in Opofinance's setup. The focus remains on the fact that the groups main trading entity is only “Offshore Regulated” and that the much‑promoted ASIC license does not authorize forex trading services. This discrepancy keeps surfacing in watchdog write‑ups, suggesting that concerns persist rather than being historical.

Such reports repeatedly urge potential clients to read beyond headlines and marketing slogans. Instead of accepting the phrase “regulated by FSA and ASIC” at face value, traders are encouraged to ask which activities each license actually covers, which jurisdiction protects their funds, and under which authority they can complain if something goes wrong. For Opofinance, those answers point back to the offshore Seychelles license as the primary framework for trading accounts.

Key Takeaways for Traders Evaluating “Opofinance Regulation”

If you are evaluating Opofinance regulation before opening an account, start by mapping where your account would legally sit and which license governs your trading activity. The Seychelles FSA license SD124 is the key authorization for leveraged forex and CFD trading, while the ASIC license 402043 is limited to investment advisory services and specifically states that it does not permit forex trading.

Next, consider whether an offshore framework with very high leverage and limited investor‑protection tools aligns with your risk tolerance. For many retail traders, the absence of strong onshore safeguards—such as compensation schemes, strict leverage caps, or robust complaints mechanisms—may be a decisive reason to look for a broker overseen directly by major regulators that clearly license forex trading itself rather than only advisory services.

Final Thoughts on Opofinances Licensing Structure

Opofinance presents itself as a broker backed by dual regulation, but a closer look at the details paints a different picture. One license comes from a light‑touch offshore jurisdiction that permits high‑risk leverage, while the other is an Australian advisory license that carries a clear disclaimer stating it does not authorize forex trading.

For traders, this configuration means the protective value of the dual‑license claim is much weaker than the marketing suggests. Before funding an account, it is wise to weigh whether the regulatory benefits you expect from the word “ASIC” are actually present in the services you plan to use, or whether your money will effectively rely on offshore rules with fewer safety nets.

Read more

4T Review: Traders Report Deposit Pressure, Fund Scams & Withdrawal Issues

Did the 4T broker deny you withdrawals after you made profits following a spell of losses? Were your funds suspiciously deleted from the broker’s trading platform? Does the forex broker tell you to deposit more once you lose capital? Have you witnessed fund misappropriation by the 4T officials? You are not alone! Many traders have expressed these concerns online. We have investigated some of the complaints in this 4T review article. Have a look!

ROCK-WEST User Reputation: Looking at Real User Feedback and Common Complaints to Check Trust

When dealing with online trading, checking things carefully isn't just a good idea - it's necessary to protect your capital. This leads us to an important question that many potential traders are asking: Is ROCK-WEST safe or scam? The answer isn't simply yes or no. To make a smart decision, you need to look beyond marketing claims and examine real facts and actual user experiences. This article provides a thorough, fact-based look into ROCK-WEST's business profile and reputation. Our goal is to help you, the trader, make a good decision. We will carefully examine the broker's regulatory status, its official rating, and most importantly, the user reviews and serious complaints sent to the financial broker checking platform, WikiFX. By looking at the positive feedback, the serious accusations and the company's official responses, we will build a complete and balanced view of the risks and benefits of trading with ROCK-WEST.

ROCK-WEST Regulation: Understanding Its License and Company Information

For any trader, the most important question about a broker is whether it is properly regulated. When it comes to ROCK-WEST, the answer is complicated and needs careful study. At first glance, ROCK-WEST is a broker regulated offshore, with a license from the Seychelles Financial Services Authority (FSA). However, this basic fact comes with serious risks that potential clients need to understand. The broker has a low trust score and many user complaints on global checking websites. These are not small problems; they show major issues with keeping funds safe and running the business properly. This article will break down the details of ROCK-WEST's license, company structure, and user reviews to give a clear, fact-based picture of what trading with this company really means. Based on information from the global broker checking platform WikiFX, ROCK-WEST's profile brings up several questions that traders need to think about. This shows how important it is to use checking tools before inves

Is ROCK-WEST Legit or Fake? A Simple Guide for Traders

The question of whether ROCK-WEST is legit doesn't have a simple "yes" or "no" answer. From a basic standpoint, it is a registered company. However, looking deeper shows several important factors that should make any potential trader very careful. Our first analysis, based on public information from regulatory agencies and user review platforms, points to two major areas of worry. First, the broker is regulated offshore. This setup naturally lacks the strong investor protections and safety programs offered by top-level financial authorities. Second, its profile shows a large number of user complaints, especially about the most basic parts of trading: depositing and withdrawing. These elements combine to create a high-risk situation, raising serious questions about the broker's overall trustworthiness and how well it operates. This article will break down these issues to give you the clarity needed to make a smart decision.

WikiFX Broker

Latest News

Why Opofinance’s Dual Licensing Looks Weak, Not Reassuring

Is Toyar Carson Limited Legit? A 2026 Investigation into Scam Allegations

Wall Street Giants Pivot: The "Reflation Trade" Returns

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Oil Markets Tighten: OPEC+ leans towards extending output pause into March

Lured by a deepfake video, retiree lost over $4,000 in an investment scheme

Rate Calc