Capital.com Review: Is Your Money Locked Inside this Broker?

Abstract:Recent investigations expose severe anomalies where Capital.com users report blocked withdrawals and demands for additional 'margin' payments to release funds. Despite holding valid licenses, the surge in access denials and a regulatory warning from Malaysia requires immediate caution.

WikiFX Special Investigator Report

For a Forex trader, the ultimate nightmare is seeing a balance on your screen but being told you must pay more money to touch it. Our active investigation into capital.com broker activity has uncovered disturbing reports that contradict its high-ranking status. While the platform holds major regulatory licenses, a flood of recent complaints suggests a different reality on the ground—one where funds are withheld, and accounts are frozen.

The Trap: “Pay to Withdraw” Demands

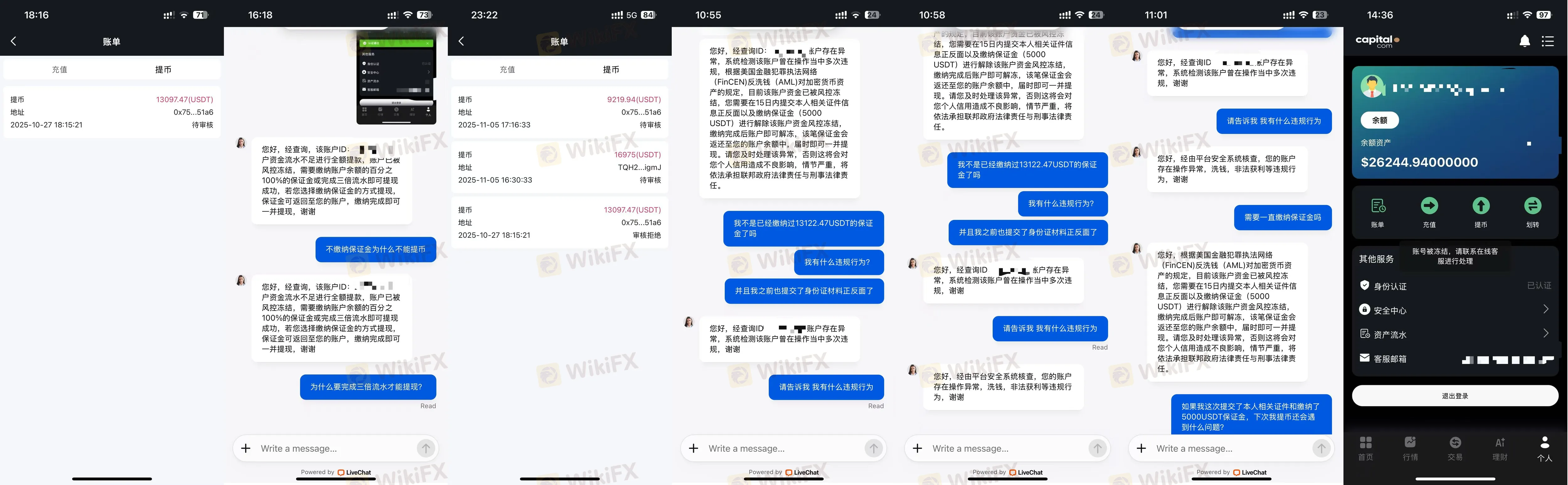

The most alarming evidence comes from our “casesText” database, where investors describe being trapped in a cycle of payments. One user, who invested over 22,987 USDT, reported a chilling scenario: after attempting to withdraw on October 27, the request was rejected due to “insufficient turnover.”

The situation escalated rapidly. When the user tried again in November, the broker allegedly cited strict “anti-money laundering” protocols and demanded a fresh deposit of 5,000 USD as a “security margin” to unfreeze the account. This is a critical red flag. legitimate Forex brokers do not ask for tax or margin payments via external deposits to release existing funds.

Another complainant echoed this distress, stating they were ordered to pay a 100% margin fee—over $13,000—within seven days. When they complied, the destination posts simply moved; they were told to pay another $5,000 or face a permanent account freeze. This pattern suggests a high-risk trap designed to drain remaining capital from desperate clients.

Capital.com Regulation & Safety Audit

How does a broker with an “AA” influence rank maintain such complaints? We dived into the capital.com regulation framework. The company operates under a complex web of licenses. While they hold authoritative status in the UK and Australia, other signals are warning lights.

Regulatory License Breakdown

| Regulator | Region | License Status |

|---|---|---|

| FCA | United Kingdom | Regulated |

| ASIC | Australia | Regulated |

| CYSEC | Cyprus | Regulated |

| SCB | Bahamas | Offshore Regulation |

| SC | Malaysia | Warning: Unauthorized |

| NBRB | Belarus | Revoked |

| FSA | Seychelles | Revoked |

Crucially, the Malaysia Securities Commission (SC) has placed Capital.com on its Investor Alert List for carrying out unauthorized capital market activities. Furthermore, licenses in Belarus and Seychelles are listed as Revoked. Traders must verify exactly which entity they are onboarding with; the safety of the UK branch does not automatically extend to the offshore Bahamas entity.

Capital.com Login Issues and Platform Instability

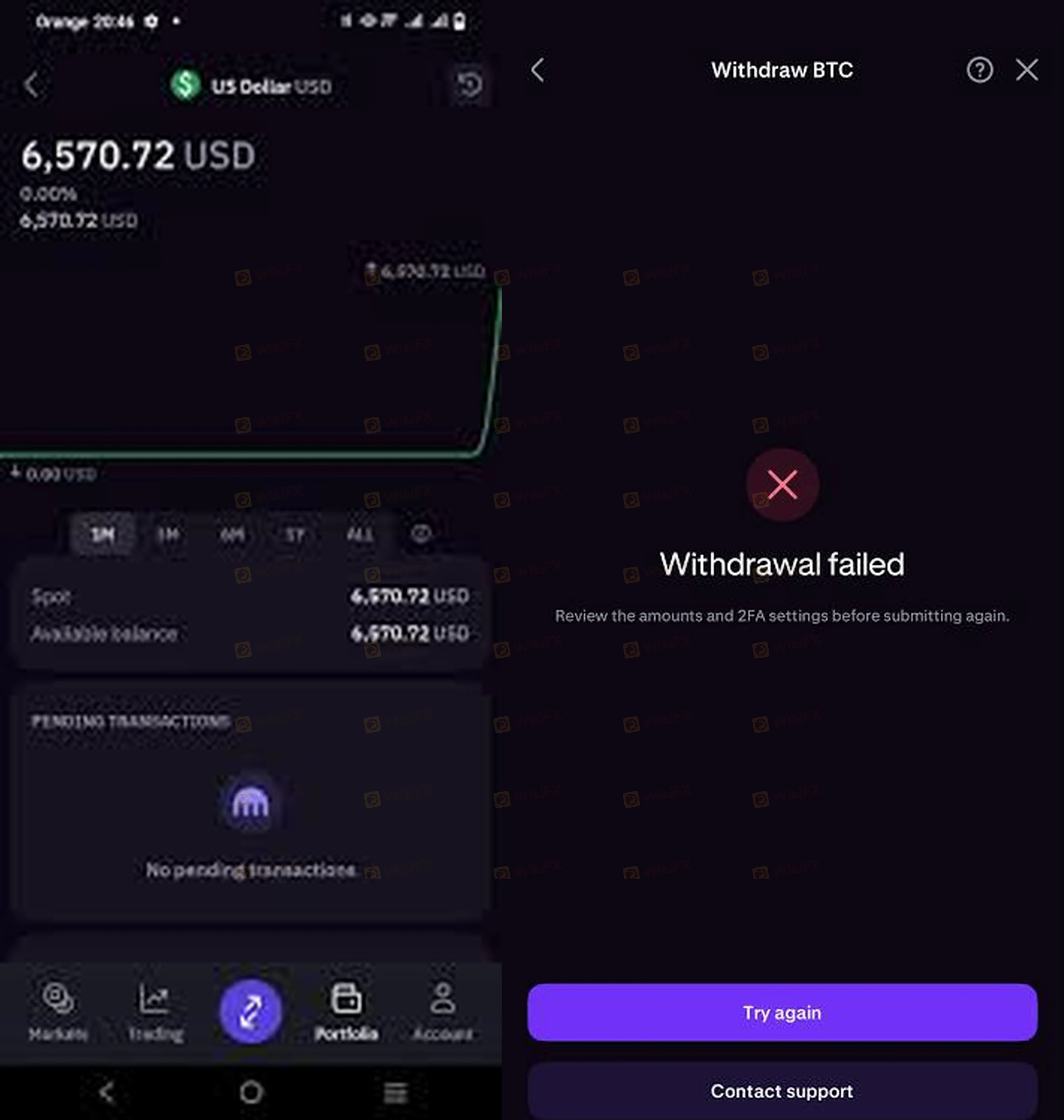

Beyond withdrawal refusals, our data indicates significant technical barriers. Multiple users have reported severe accessibility problems, specifically regarding the capital.com login process.

One persistent case from the US detailed an inability to withdraw due to “invalid account name” errors, despite using the exact bank account previously used for deposits.

Another user described a “trading nightmare” involving total website inaccessibility and slow support response times. When a Forex platform suffers from disconnects or blocks access to the trader's dashboard, it prevents effective risk management and exit strategies.

Key Red Flags Detected

- Withdrawal Extortion: Reports of users being forced to pay “margin” or “taxes” (up to $13,000) to access their own funds.

- Regulatory Warning: Listed as “Unauthorized” by the Malaysia Securities Commission.

- Profit Cancellations: Users report that normal trading is allowed when losing, but profits are flagged as “abnormal” and canceled.

- Surge in Complaints: WikiFX has received 32 complaints in just the last three months.

The Verdict

This capital.com review concludes with a severe advisory. While the broker possesses high-tier licenses (FCA, ASIC), the Offshore and Unauthorized elements of its operation—combined with user testimony of funds being held for ransom—cannot be ignored.

The demand for “security deposits” to process withdrawals is highly irregular for a regulated entity. Traders are urged to avoid depositing further funds if faced with these demands and to report the issue immediately.

<p style=“color: red; font-weight: bold;”>WikiFX Alert: If you cannot withdraw, DO NOT payload more margin. Protect your remaining capital.</p>

WikiFX Broker

Latest News

MultiBank Group Review: A Regulatory Titan or a Master of Liquidation?

XSpot Wealth Exposure: Traders Report Withdrawal Denials & Constant Deposit Pressure

Is Fortune Prime Global Legit Broker? Answering concerns: Is this fake or trustworthy broker?

AssetsFX Regulation: A Complete Guide to Licenses and Trading Risks

ZaraVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Pinnacle Pips Forex Fraud Exposed

ZarVista User Reputation: Looking at Real User Reviews to Check if It's Trustworthy

Grand Capital Review 2026: Is this Broker Safe?

TP Trader Academy ‘The Axis Event’: Pioneering Trading Education at the Heart of Tech and Data

S. Africa Energy Gridlock: Glencore Proposal Stalls Amid Regulatory Clash

Rate Calc